With the end of the financial year approaching, it’s a great time to make smart decisions about your finances. Taking action before 30 June can open up more opportunities for you.

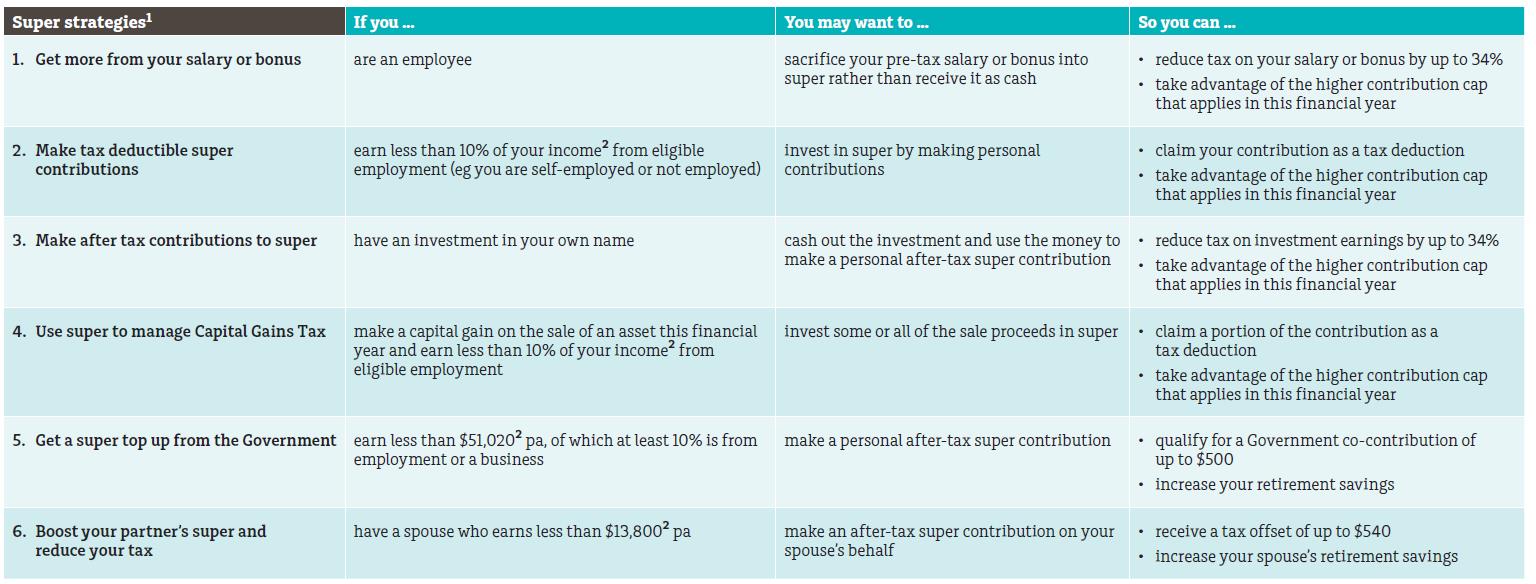

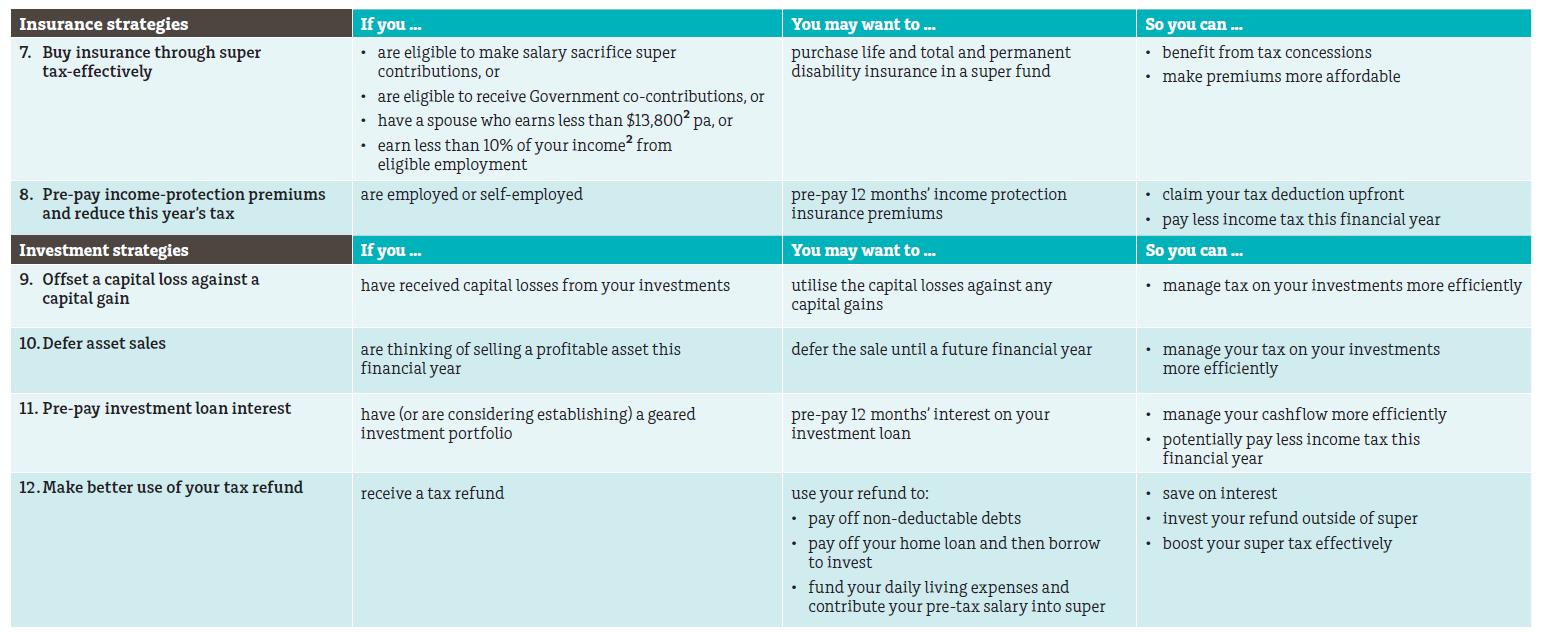

We know that there isn’t a one-size-fits-all solution to wealth management. So we’ve outlined 12 tax-effective strategies that you could benefit from. We can help you find what strategies are right for you, so you can benefit now and also save your retirement.

So now is the time to make sure you plan what needs to be considered leading up to 30 June. You also need to make sure the decisions are right for your personal circumstances so contact us to speak to your independent adviser.

Note: To use strategies 1 to 7, you generally need to be eligible to make super contributions. Furthermore, you won’t be able to access your super until you satisfy a condition of release.

1 Super strategies should be in consideration of concessional and non-concessional caps. Penalties may apply if these caps are exceeded.

2 Includes assessable income, reportable fringe benefits and reportable employer super contributions. Other eligibility conditions apply.