Learn About the Value of Advice

So what is the Value of Advice?

Russell Investments, in a 2024 report estimated that advisers deliver value of at least 5.7% or more every year to their clients beyond investment-only advice.

Extract from Russell Investment 2023 Value of an adviser report;

Advisers continue to provide clients with advice that enables them to achieve long-term financial goals in a constantly changing and complex world.

In 2024, that has meant balancing the competing emotions triggered by strong investment returns and a cost of living crisis. Advisers have encouraged clients to stick to their long-term goals in this environment by providing both practical and emotional guidance that allows them to navigate the highs and lows of wealth generation.

Advisers’ counsel helped people adhere to principles such as asset allocation by reweighting portfolios as stock markets reached new highs. Equally, it has encouraged clients to retain dollar cost averaging even as household budgets are squeezed by rising prices.

For younger generations, it has helped them make the multitude of decisions required to enter the housing market, start families and pay off HECS debts. Older people have been better able to plan for retirement and their own parents’ aged care by engaging advisers.

Of course, this counsel encompasses much more than investing. It requires in-depth knowledge of taxation, superannuation and social security, plus the understanding of human behaviour required to support people making life decisions.

Advisers continue to prove up to this challenge. Russell Investments’ annual analysis shows the total value of an adviser in Australia is approximately 5.7% in 2024.

This is substantially higher than the typical fee charged by advisers and a validation of the holistic service they provide to clients. It is a function of their ability to help clients adapt as markets, regulations, and their own circumstances change.

Value of Adviser Formula is:

So where is the value.

Click here for the full report

Feedback on why our clients value our advice:

“Optimising our finances”, “Achieving our specific goals”, “Establishing ourselves financially”, “Facilitating our transition to a new life stage”, “Provides us with a reality check when needed”, “manages my anxiety about money”, “helps improve my financial knowledge”.

Why do people need advice?

Firstly, if you think that relying on your employer contributions will be enough for your retirement….THINK AGAIN!

It doesn’t matter whether it’s an employer fund, corporate superannuation, industry fund or your own superannuation fund you need to also get professional strategic financial advice if you want to achieve your goals.

It is very difficult for a 65 year old who, after 45 years of work, has relied on employer superannuation contributions to have enough to retire comfortably.

So why is strategic advice necessary?

The system of retirement planning, superannuation and financial services in Australia is complex. People need advice in these areas. Not enough people are currently receiving it and as such their financial futures are potentially disadvantaged.

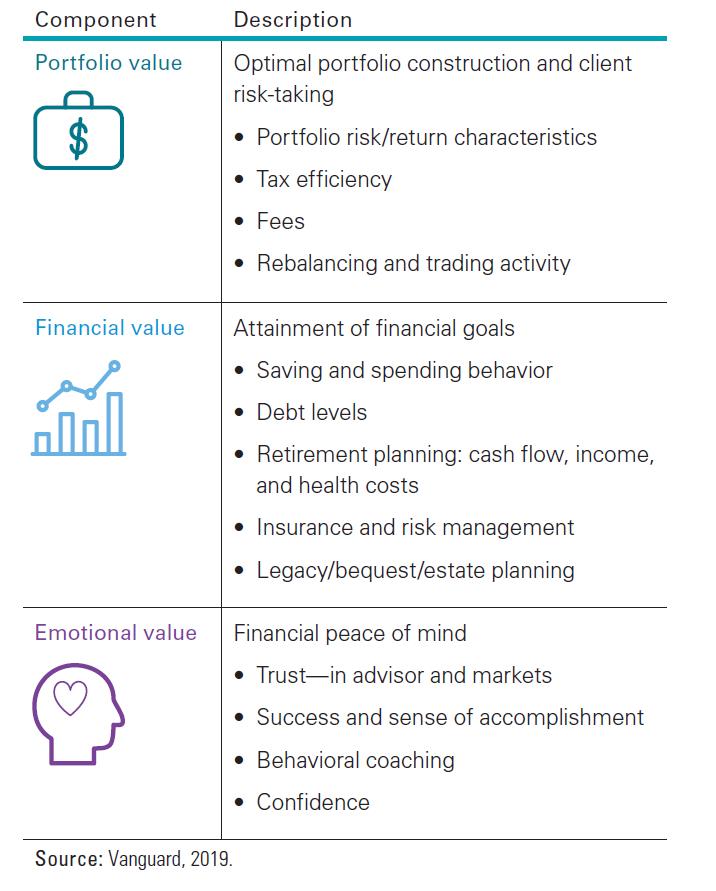

Those individuals who receive advice tend to be more informed and more concerned about current investment and legislative conditions than those who do not receive advice. Advised clients report receiving value from their advisor in three broad ways – Portfolio, Financial and Emotional value.

Portfolio value. The first dimension concerns the portfolio designed for the investor. Value comes from building a well-diversified portfolio that generates better after-tax risk-adjusted returns net of all fees, suitably matched to the client’s risk tolerance. Portfolio value can be quantified in many ways, including different measures of portfolio risk-adjusted returns, diversification and allocation metrics (such as active/passive share), the impact of taxes, and portfolio fees.

Financial value. The second dimension assesses an investor’s ability to achieve a desired goal. A portfolio does not stand on its own. It is in service to one or more financial goals, such as retirement, growth of wealth, bequests, education funding, and liquidity reserves.

Emotional value. The third dimension is an emotional one: financial well-being or peace of mind. The value of advice cannot be assessed by purely quantitative measures. It also has a subjective or qualitative aspect based on the client’s emotional relationship with the advisor (or, in the case of robo-advisors, with the institution and its brand). Underlying elements include trust (in the institution or advisor), the investor’s own sense of confidence, the investor’s perception of success or accomplishment in financial affairs, and the nature of behavioral coaching such as hand-holding in periods of market volatility.

How is value added by receiving Financial Advice?

Financial Advice is provided to an individual or family group to assist them to grow, manage and protect their wealth. Financial Advice adds value in two ways……

First, and most importantly the strategic advice and secondly, asset management.

Strategic advice includes focusing on your lifestyle and financial objectives, assessing the four key drivers (earn more income, pay less tax, protect your estate and effectively use assets and cash flow) for creating wealth, identifying the appropriate structures and providing constant revision, planning, managing and reporting. Strategy construction includes the impact of legislation, taxation and other external factors on your financial position.

Strategic Advice includes the following:

- Lifestyle Benefits;

- Debt Reduction;

- Cash Flow Management;

- Taxation Management;

- Risk Protection;

- Maximising Government Benefits;

- Enhancing Retirement Savings;

- Goal Setting and;

- Wealth Creation.

The benefits to you of good financial advice include

- Feeling of a clear sense of direction from having a framework for wealth management

- Peace of mind in knowing that you are:

- Managing the return on your assets within your level of comfort with risk;

- Utilising your surplus cashflow in the most effective manner;

- Paying as little tax as reasonably and legally possible;

- Owning your assets in the most appropriate family member’s name or legal structure;

- Taking advantage of tax concessions and government benefits that you are eligible for;

- Transferring wealth to your children/spouse/beneficiaries tax effectively and in line with your wishes;

- Entrusting us to take care of your children’s/family’s affairs and finances in the event of your premature death;

- Entrusting us to continue to take care of your affairs and finances in the event you are no longer willing or in the frame of mind to do so;

- Make rational decisions and not emotional knee-jerk reactions during future global financial crises as a result of our objective advice; and

- Staying on track to achieve your goals via our ongoing reviews, planning meetings and management.

- Being looked after by an adviser with whom you will have a personal long-term relationship and whom will know your family’s individual circumstances.

- Reduce the stress of managing your financial affairs by transferring part of the responsibility.

- You are employing a financial manager who has access to:

- Legislative, economic and technical updates;

- Investment research;

- Wide range of investments at wholesale cost;

- Asset allocation research;

- Wide range of insurers;

- Network of professionals in the areas of accounting, taxation, finance, estate planning and legal structures.

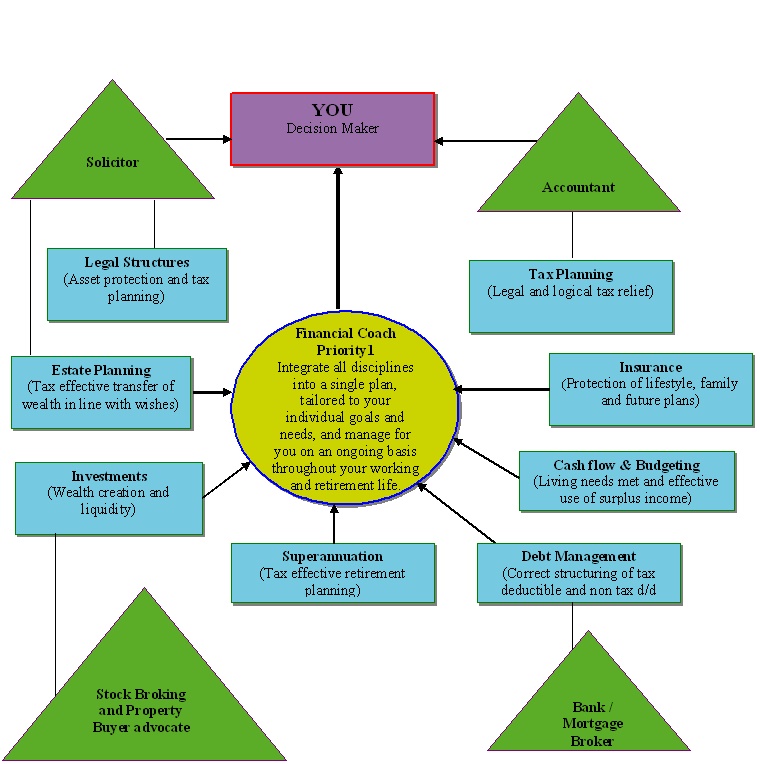

So how does a financial adviser help achieve this?

A good adviser can best be portrayed in the following way:

So what is the dollar value of good financial advice?

To ensure that you take advantage of or at least investigate the above, you need a close working relationship with a good financial planner.

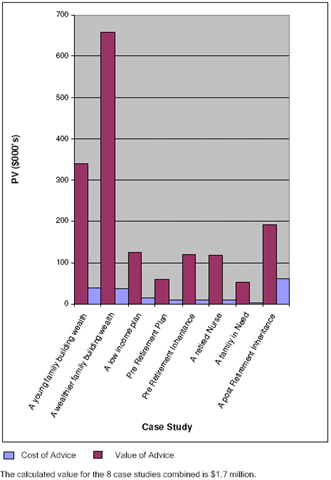

A study conducted by Rice Warner Actuaries, examined a number of case studies relating to advice provided to individuals and families. These case studies were analysed to provide a dollar figure benefit of the advice over the period of time the advice would be required. The case studies have a planning horizon ranging from 4 to 30 years.

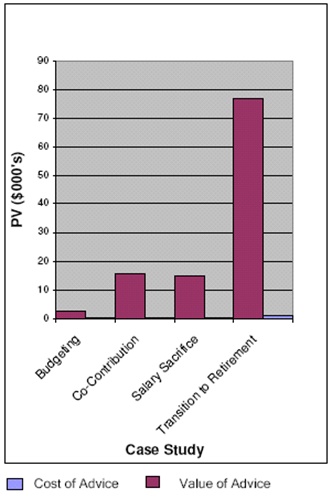

The chart below shows the value created for each case study. The value varies from case to case as there are differences in relative income and expenditure patterns, time horizons and goals.

The charts demonstrate there is a key advantage in having an ongoing relationship with a financial planner in order to maximise opportunities and build the discipline of maintaining the long term plans for both full advice and limited advice strategies.

Value added relative to Cost of Advice

– Full Advice Case Studies

Value added relative to Cost of Advice

– Limited Advice Case Studies only

What are the costs of Financial Advice?

In addition to the financial value of advice, there is an emotional value provided from the peace of mind associated with a structured and stable plan, as outlined above.

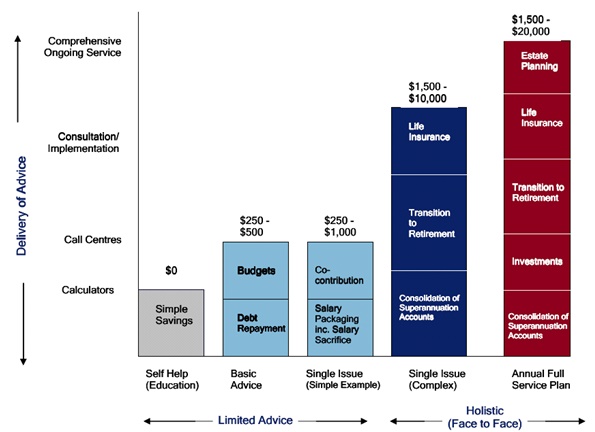

The cost of delivering advice ranges depending on the complexity of advice required. These costs can be paid either via upfront payment or through a fee based on assets under advice or a flat dollar fee.

Advice obtained through self help (education) and call centres can be relatively cheap. More complex matters need to be dealt with through a face to face meeting. Value can be provided through a single review although the most comprehensive advice is provided through a continuous service with frequent reviews. This holistic advice requires a personal relationship with a financial planner and advice which takes into account all aspects of a client’s personal circumstances.

The cost of this advice varies depending on individual’s personal situation. Advisers are always upfront with fees and charges and will discuss these prior to any advice being given.

The table below shows the difference in cost and complexity of various pieces of advice.

Summary

Financial Advice is valuable and more Australian’s should receive it. Surveys have indicated that 9 out of 10 Australian’s benefited from the experience of using a financial planner.

While there is a cost associated with providing advice, the rewards of following the plan provided by the adviser, far outweigh the costs.

For more information or to arrange a meeting please call Priority1 Wealth Management Group (Australia) Pty Ltd on (03) 9725 9078 or Contact Us to discuss.