Personal Insurance

Having adequate personal insurance cover in place is important as it ensures that both you and your family are protected in the event of death, total and permanent disability, illness or injury. The most common forms of personal insurance cover are:

- Death (also known, paradoxically, as ‘Life’ insurance)

- Total and permanent disability (TPD)

- Trauma

- Income protection

Life, TPD and trauma cover all pay lump sum benefits upon the occurrence of the insured event, while income protection insurance provides a regular benefit payment over the entire period of cover.

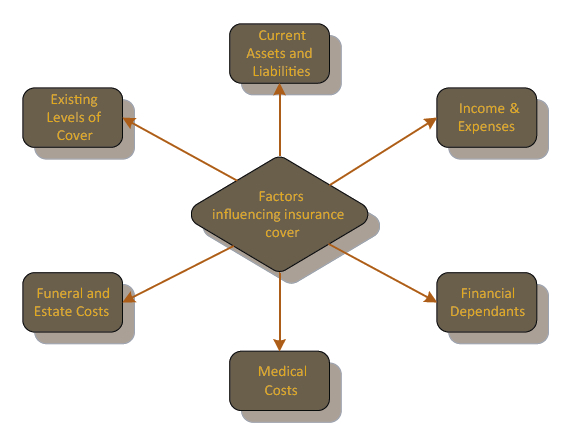

There are a number of factors that need to be considered when determining an appropriate level of personal insurance cover as indicated in the chart.

Tax deductibility can be achieved from certain types of insurance cover and it is possible to structure some of your cover through superannuation, reducing or eliminating the impact on your day-to-day cash flows.

Contact Priority1 for further information on determining appropriate types and levels of cover, and also on how to structure your insurance in the most effective way. We do not provide specific product recommendations in relation to Personal Insurance. If individual product recommendations are required we will refer you to our Personal Insurance specialist partner.