A study conducted by the Australian Stock Exchange reported that nearly 25% of investors over the past two years were aged 18 to 24.

These young Australians were found to be knowledge seekers, keen to take on life and begin their journey towards financial security.

If this describes you, congratulations! You get it, you really do. You’re Next Generation Investors who know that building financial independence starts early.

However, according to the same study, Next Generation Investors, aware of their inexperience, are uncomfortable making financial decisions.

If this is also you, here are our tips for laying the foundations for a wealthy future!

Avoid unnecessary debt

If there’s one thing guaranteed to keep you awake at night it’s debt. Naturally, some debt can’t be avoided and is considered ‘good’ debt, like when you borrow to buy a house.

But ‘bad’ debt is sometimes unnecessary and often comes with high interest; best avoided where possible. You know we’re talking about credit cards, right?

Credit cards can fast-track you into debt-strife, particularly as tap-and-go transactions are just so quick and so easy.

Additionally, while those buy-now-pay-later schemes can be useful for emergencies if, say, your fridge packs up, they’re a trap if you don’t stay in control.

Sure, online shopping and bill-paying means using cards but you can avoid using credit.

Functioning the same as credit cards, debit cards use your money instead of the bank’s. They can be linked to your bank account, or loaded with cash which is handy for keeping track of your spending, as you can only spend as much as you’ve loaded.

If you do end up with debt, be accountable. Pretending it’s not there won’t make it go away. Further, unpaid bills can grow through late fees and penalties.

Read the fine print on contracts and understand what you’ve signed up for. Late payments and loan defaults can result in legal action, even bankruptcy, destroying your credit rating for years!

Pay down debt as soon as you can by:

- making additional payments where possible.

- paying above the minimum monthly amount.

- consolidating debts, and negotiating a better deal.

- prioritising debts with the highest interest rate.

Track spending

On the topic of spending, get into the habit of tracking yours. Using a simple spreadsheet, or an app from your bank, log your purchases and reconcile spending with receipts.

You’ll see exactly where your money is going and spot any areas of unnecessary spending, like those items you really don’t need but are the coolest ‘must-haves’.

Don’t fall for it; ‘must-have’ is a marketing term. True must-haves are basics like food, shelter, transport and medical – not the latest trends and gadgets.

We’re not saying don’t treat yourself occasionally, but to pause and consider whether the item is really worth burdening yourself.

Superannuation

Think you’re too young to worry about superannuation? Prefer to put your money toward something for now rather than later?

You may be right, but don’t dismiss super altogether. Here are some things you can do that won’t impact your current finances:

- Ensure your employer is contributing the correct amount of super. If you are earning more than $450, pre-tax in any calendar month, your employer must contribute 10% to a super fund on your behalf. These contributions are Superannuation Guarantee Contributions (SGC) and they are compulsory.

- Low-income earners may qualify for Government Co-contributions where the government contributes up to $500 to your super fund. When you lodge your tax return, your eligibility is automatically assessed, and if you qualify the government deposits directly into your super account.

- Put unforeseen cash into super. Sure, you’re locking it away, but it’s money you weren’t expecting anyway! The longer it’s in super, the more it can potentially grow.

Save Vs Spend

You’re entitled to live, and you’re entitled to a social life. We’re not saying save or spend, we’re suggesting you can do a bit of both.

This is how it works:

| Scenario 1 | Scenario 2 | Scenario 3 | |

| Initial Deposit | $1,000 | $1,000 | $1,000 |

| Interest Rate | 2% PA | 2% PA | 2% PA |

| Regular Deposit | N/A | $50 per month | $100 per month |

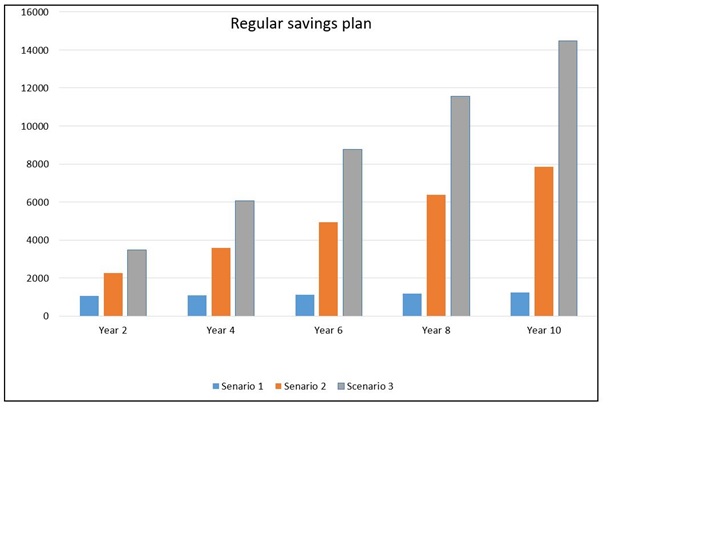

The chart below shows the result of the above scenarios after ten years.

Each scenario is based on a $1,000 initial deposit with 2% PA interest calculated monthly. In Scenario 1 no further deposits are made. Scenario 2: shows $50 monthly deposits, and Scenario 3: $100 monthly deposits.

Each scenario is based on a $1,000 initial deposit with 2% PA interest calculated monthly. In Scenario 1 no further deposits are made. Scenario 2: shows $50 monthly deposits, and Scenario 3: $100 monthly deposits.

Adjust the figures to suit your personal budget and commit to saving a small amount each pay while still enjoying a life. Have the amount automatically deducted from your account and soon you won’t even miss it!

Regular savings accounts are available from banks and other financial institutions, and offer a variety of arrangements. For example:

- Your initial deposit can be as little as $50.

- Some pay bonus interest if no withdrawals are made in a month.

- Some offer higher interest for 18 – 24 year olds.

Do your research, particularly websites providing independent product comparisons.

Seek advice

A professional financial planner can tailor a plan specifically for you. They will consider your debt, income, goals and much more, and work with you to structure a strategy for now, and into the future – you may even be surprised at how inexpensive good advice can be.

So, there you are! The future is laid before you and it’s loaded with potential; all you need to do now is get on with it.