“Just keep swimming, just keep swimming.”

Dory, Finding Nemo

As volatility in markets continues to test investor resolve, we think all investors could learn something from Dory.

This basic investment principle of staying invested sounds easy enough, but it gets trickier in practice. In our investment manager, Morningstar’s, annual Mind The Gap study, they found that on average, the actual return enjoyed by investors was 1.7% lower per year than the total return their fund investments generated over the same period*. While this may seem like a small difference, compounded over many years and into retirement, the opportunity cost is significant.

So – why the difference? Why do investors consistently leave returns on the table? To quote the findings, “Inopportunely timed purchases and sales cost investors about 22% of the return they otherwise could have earned had they bought and held.”

While cost, tax positions and other cash flow variables also need to be considered, the chart below helps to illustrate the importance of time in the market versus timing the market – a crucial and often expensive distinction.

Source: Clearnomics, CBOE

Past performance is no guarantee of future results. This is for illustrative purposes only and not indicative of any investment. An investment cannot be made directly in an index. References to specific asset classes should not be viewed as a recommendation to buy or sell any specific security in those asset classes.

Investors who attempt to time the market run the risk of missing periods of positive returns, which can lead to significant adverse effects on the long-term value of a portfolio.

The chart above illustrates the value of a $100,000 investment in the stock market during the period 2005–2024, a period which included the Global Financial Crisis (the grey highlight) and the recovery that followed. The value of the investment dropped back to around $100,000 by February 2009 (the trough date), following a severe and protracted market decline. If you remained invested in the stock market until the end of August 2024, however, the ending value of your investment would be around $743,000. If you chose to exit the market at the bottom to invest in cash for a year and then reinvested in the market, the ending value of your investment would be around $434,000. An all-cash investment from the bottom of the market would have yielded an end value of only $174,000. While all market recoveries are not equal and may not yield the same results, staying the course has historically proved to be the best option for patient investors and removes the difficult decision of when to re-invest from the sideline.

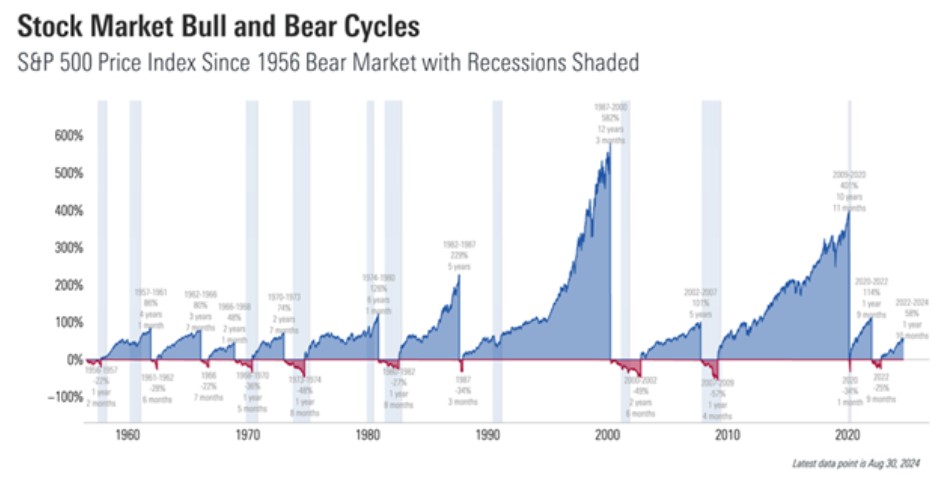

A final point to make is that it pays to see the glass half-full when investing. The graph below represents the S&P 500 Index which stands for the Standard and Poors 500 Index, an Index of 500 large companies listed on the US stock exchange.

Source: Clearnomics, CBOE

Past performance is no guarantee of future results. This is for illustrative purposes only and not indicative of any investment. An investment cannot be made directly in an index. References to specific asset classes should not be viewed as a recommendation to buy or sell any specific security in those asset classes.

While enduring the recessionary periods (the red) are painful in the moment, history shows that eventually, all bear markets have found a trough, paving the way for subsequent economic expansion and more bullish recovery. These phases of the economic and market cycle are not created equal. As the chart above shows, bear markets since 1956 have lasted anywhere from 6 months to two-and-a-half years. During these periods, the U.S. stock market has fallen anywhere from 22% (1957) to 57% (the 2008 financial crisis) at their worst points.

In contrast, bull markets (in blue) have lasted from about 2 years to over a decade in length, with the two longest cycles occurring during the past 30 years. The eleven-year bull market that ran from 2009 to 2020 experienced a price return of 401% and close to a 530% return with dividends re-invested. Investors who stayed the course once again came out on top.

So, in the face of market volatility, and the next inevitable market correction, Dory’s motto reigns supreme. Or, if you need a reminder from Warren Buffet, Chairman and CEO of Berkshire Hathaway: “The stock market is a device for transferring money from the impatient to the patient.”

If you have any questions about this note, or about your investments generally, please feel free to get in touch – We are always happy to chat.