At 7:30pm on Tuesday 25 March 2025, the Treasurer, Jim Chalmers, released the Government’s 2025-26 Budget. The Treasurer identified five main Budget priorities:

• Helping with the cost of living;

• Strengthening Medicare;

• Building more homes;

• Investing in every stage of education; and

• Making our economy stronger, more productive and more resilient.

The Budget features a number of measures that will impact both pre and post retiree clients, including aged care participants, and these measures are the focus of this analysis.

It is important to note that at this time any proposed measures are not yet law and could change through implementation.

Summary of key proposals |

| · All taxpayers will receive modest tax cuts starting from 1 July 2026.

· Eligible Australian households and small businesses will receive an additional energy rebate of $150. · The general co-payment for Pharmaceutical Benefits Scheme medicines will reduce to $25 for individuals who don’t hold a concession card. · All families will be eligible for at least 72 hours per fortnight (three days per week) of subsidised childcare without having to satisfy the activity test. · Concessions will be applied to reduce student debts and repayments. · The ‘Help to Buy’ program will be expanded to include higher income and property price caps. |

Tax

Reduction in the lowest marginal tax rate for individuals

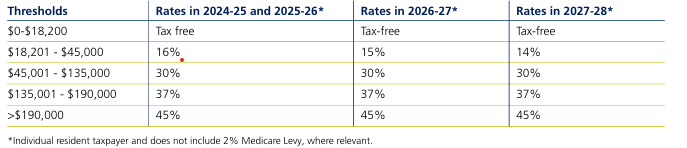

The lowest individual marginal tax rate will be reduced over two financial years from the current 16% to 14%. From 1 July 2026, the 16% tax rate, which applies to taxable income between $18,201 and $45,000, will be reduced to 15%. From 1 July 2027, this tax rate will be reduced further to 14%.

The reduction in the lowest marginal tax rate means that in 2026-27, individuals may see a tax reduction of $268 and in 2027-28

and future years, a reduction of $536 per year compared to the 2024-25 tax rates.

Impact on financial planning strategies

While the reduction in the lowest marginal tax rate from the current 16% to eventually 14% in 2027-28 is modest, nonetheless, it may result in more cashflow. There may be some impact on financial planning strategies such as:

• Weighing up the benefit of salary sacrifice / personal deductible super contributions for those with income less than $45,000

• Preference of non-concessional contributions over concessional contributions for those with income less than $45,000

• Higher Seniors and Pensioners Tax Offset thresholds

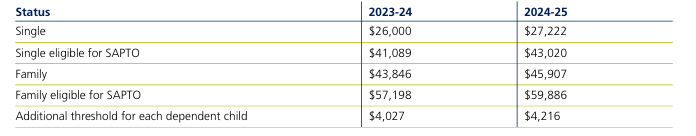

Increasing the Medicare Levy low-income thresholds

The Medicare Levy low-income thresholds to be exempt from paying the Medicare Levy for singles, families and seniors and pensioners will increase in 2024-25.

Social Security

No mention of further freezing of deeming rates

Deeming rates have been frozen since 1 July 2022 and were intended to be applicable for two years until 30 June 2024. This was extended for another year in last year’s Federal Budget with historically low deeming rates continuing to be frozen until 30 June 2025.

While the Budget is silent on the issue of deeming, recent media reports indicate that the Government will seek to hold deeming rates at their current levels beyond 1 July 2025.Currently deeming rates and thresholds are:

While deeming thresholds are indexed to CPI each year on 1 July, deeming rates are determined by the Minister for Social Services through a legislative instrument. However, it is unclear at this stage if and when the Minister will issue another legislative instrument to change deeming rates.

3-day guarantee’ for child care subsidy

Families will be eligible for at least 72 hours per fortnight (three days per week) of subsidised Early Childhood Education and Care (ECEC) without having to meet certain activity requirements (such as paid work, volunteering and studying). Families that still meet activity requirements, care for a First Nations child or have a valid exemption, can continue to get 100 hours of subsidised ECEC. A family income test limit ($533,280 in 2024/25) will still need to be met to be qualify for subsidised care. This measure is legislated to start from 1 January 2026.

Aged care

Implementation of aged care reforms

The Government will provide additional funding over five years from 2024-25 to continue delivery of the aged care reforms:

• $116.1 million in 2025–26 in additional funding for the Aged Care Quality and Safety Commission to deliver its regulatory functions under the Aged Care Act 2024

• $53.2 million in 2025–26 to continue implementation of the Single Assessment System and support the staged digital implementation of the Aged Care Act 2024 to ensure continuity of aged care assessment services

• $47.6 million over four years from 2025–26 to support First Nations organisations to deliver culturally appropriate aged care assessments for First Nations people

• $24.4 million in 2024–25 for additional Commonwealth Home Support Programme assessments to meet new requirements under the Aged Care Act 2024

• $7.8 million in 2025–26 for the Aged Care Quality and Safety Commission to support the staged digital implementation of the Aged Care Act 2024

Funding pay increases for aged care workers

The Government will provide additional funding over five years from 2024-25 to fund the outcome of the Fair Work Commission’s decision to increase the minimum award wages of registered and enrolled nurses employed in the aged care sector:

• $48.7 million over three years from 2024–25 for Commonwealth Home Support Programme providers to cover the cost of the increase in award wages

• $35.5 million over two years from 2025–26 to fund historical leave provisions for Commonwealth-funded aged care providers

The Government will also provide an additional $2.5 billion over five years from 2024-25 (and an additional $6.1 billion from 2029-30 to 2034-35) to meet the cost of the Fair Work Commission’s decision for aged care nurses with funding to other aged care programs including residential aged care, the Home Care Packages program and the Support at Home program.

Other Budget measures

Energy bill relief

As a relief measure for all eligible households and small businesses to help with the rise in energy costs, the Government has proposed to extend the existing energy bill rebate for another six months until 31 December 2025. Eligible households and around 1 million small businesses will each receive $150 from 1 July 2025 ($75 per quarter).

Eligible households who receive an electricity bill and are connected to the grid are generally eligible for rebates to the end of 2025. Small businesses must meet their state and territory definition of electric ‘small customer’ as determined by their annual electricity consumption threshold, to be eligible for rebates.

As with current arrangements, the energy provider will deliver the rebate to eligible households and small businesses through a quarterly reduction in their energy bills.

Student loans to be cut by 20%

Student loans will be reduced by 20% before the annual indexation is applied on 1 June 2025. The changes will apply to all HELP Student Loans,

VET Student Loans, Australian Apprenticeship Support Loans, Student Start-up Loans and Student Financial Supplement Scheme.

Reduced student loan repayments

The income that can be earned before student loan repayments need to be made will be increased from $54,435 in 2024/25 to $67,000 in 2025/26.

Also, repayments will be calculated on just the income earned above the $67,000 threshold, not on total income. The list of eligible student loans is covered in the measure above.

Expanding bulk billing incentives

The Government announced funding of $7.9 billion over four years starting from 1 November 2025 to expand the availability of bulk billing incentives to all Australians eligible for Medicare. Currently only those aged under 16 years or who hold a concession card are eligible for bulk billing incentives.

The funding will also introduce an additional incentive program – the new Bulk Billing Practice Incentive Program – for general practitioners (GP) if they bulk bill every visit under Medicare. Practices participating in the Program will receive an additional 12.5% incentive payment on every $1 of Medicare Benefit Scheme benefit earned from eligible services, split between the GP and

the practice.

The Government anticipates that nine out of ten GP visits are expected to be bulk billed by 2030.

Cheaper medicines

The Government is lowering the maximum cost of medicines on the Pharmaceutical Benefits Scheme (PBS) for everyone with a Medicare card and no concession card. From 1 January 2026, the maximum co-payment will be lowered from $31.60 to $25.00 per script and remain frozen at $7.70 for concession card holders.

Expanded ‘Help to Buy’ program

The Help to Buy program was established to assist eligible individuals with the purchase of a principal place of residence. Expected to commence later this year, the Commonwealth will provide an equity contribution up to 30% of the purchase price of an existing home and up to 40% of the purchase price of a new home. The income cap and property price caps used to determine eligibility will increase. For singles, the income cap will increase from $90,000 to $100,000. For joint applicants (and single parents), the income cap will increase from $120,000 to $160,000. The property price cap depends on the location of the property and details can be found in the Government’s media release.