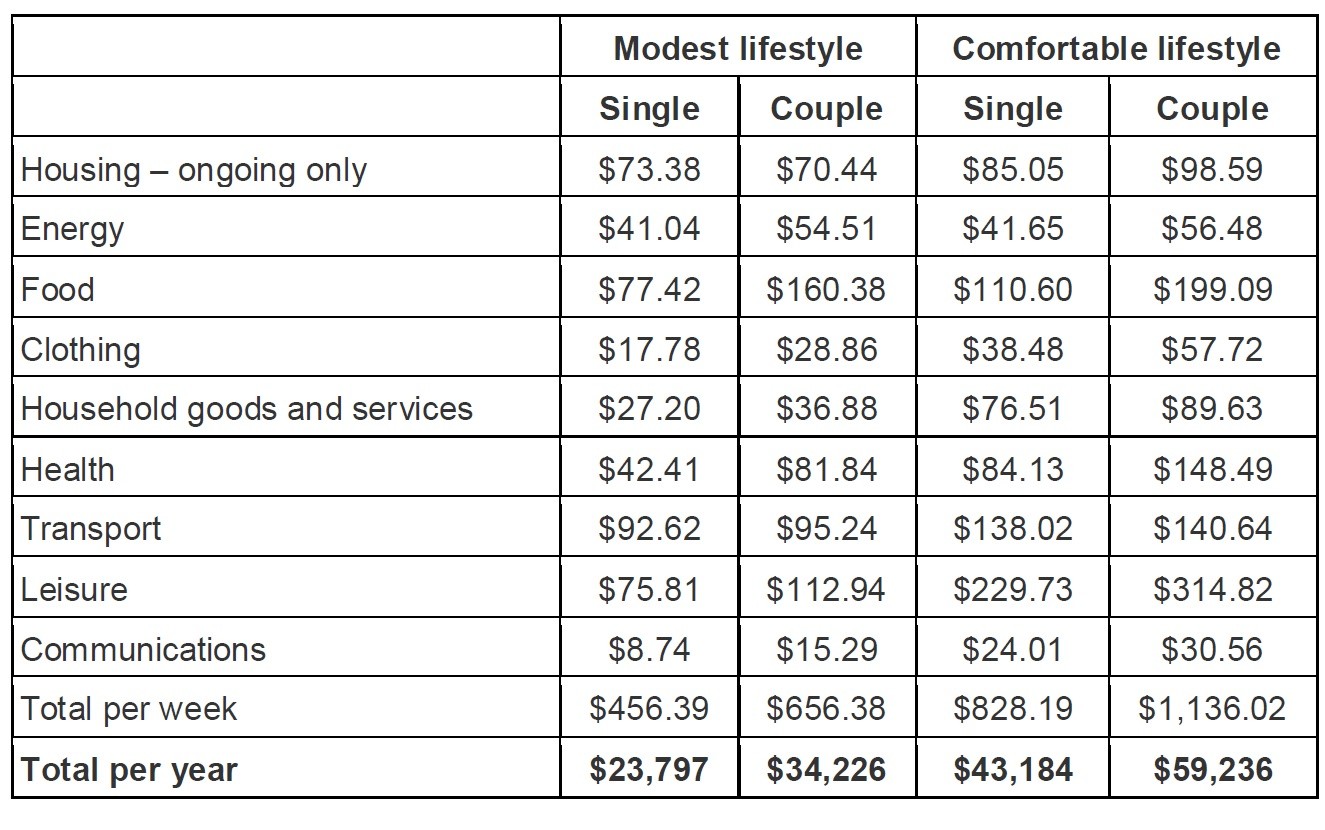

The Association of Superannuation Funds of Australia (ASFA) Retirement Standard December quarter figures indicate another modest rise in the cost of living for retirees, with couples aged around 65 living a comfortable retirement needing to spend $59,236 per year and singles $43,184, both 0.5 per cent increases on the previous quarter. Total budgets for older retirees also increased by 0.5 per cent at both the comfortable and modest levels.

“The cost of retirement has not substantially increased over the past few quarters, which is positive for current retirees,” explained Pauline Vamos, chief executive officer, ASFA.

“However, many Australians are still retiring with an inadequate amount of superannuation. In order to achieve a comfortable standard of living in retirement, an individual requires a minimum of around $545,000 and a couple around $645,000.”

The most significant price rises in the December quarter contributing to the increase in the annual budgets were domestic holiday travel and accommodation (+5.9 per cent) and international holiday travel and accommodation (+2.4 per cent). The most significant offsetting price falls were automotive fuel (-5.7 per cent), fruit (-2.6 per cent) and communications (-2.4 per cent).

The rise in domestic holiday travel and accommodation prices was due to the October school holiday period and the lead up to the peak holiday period at the end of the year. Over the last 12 months, domestic holiday travel and accommodation prices increased 2.7 per cent.

The main contributors to the rise in the food group this quarter were take away and fast foods (+1.3 per cent) and vegetables (+1.9 per cent). The rise was partially offset by a fall in fruit prices (-2.6 per cent).

Insurance prices increased 2.1 per cent in the quarter. Over the last 12 months insurance prices increased 3.8 per cent.

Automotive fuel prices fell in October (-2.0 per cent), November (-0.8 per cent) and December (-2.1 per cent). Falls in world oil prices continue to influence domestic fuel prices. All fuel types, excluding LPG, recorded decreases.

The main contributor to the fall in the communication group this quarter was telecommunication equipment and services (-2.4 per cent). Over the last 12 months, the communication group fell 6.3 per cent.

“The earlier you engage with your superannuation, the easier it will be to accumulate enough to support you in your post-work years. Check your balance, contact your fund and set yourself up now for a comfortable retirement,” Ms Vamos concluded.

Table 1: Budgets for various households and living standards for those aged around 65 (December quarter 2015, national)

The figures in each case assume that the retiree/s own their own home and relate to expenditure by the household. This can be greater than household income after income tax where there is a drawdown on capital over the period of retirement. Single calculations are based on female figures. All calculations are weekly, unless otherwise stated.

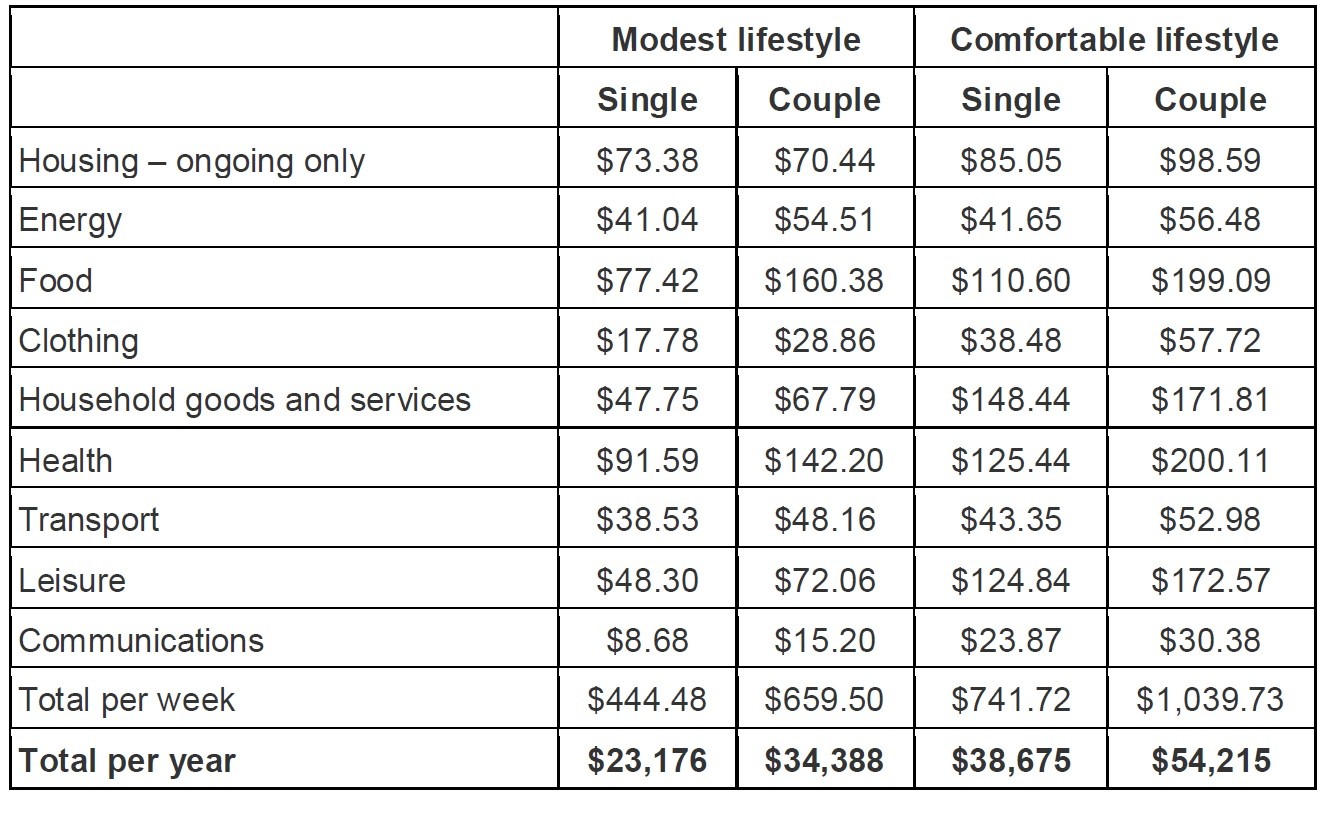

Table 2: Budgets for various households and living standards for those aged around 85 (December quarter 2015, national)

The figures in each case assume that the retiree/s own their own home and relate to expenditure by the household. This can be greater than household income after income tax where there is a drawdown on capital over the period of retirement. Single calculations are based on female figures. All calculations are weekly, unless otherwise stated.

Source: www.professionalplanner.com.au