Buoyed by a stronger economy, the 2018 Federal Budget promises to deliver income tax relief, more jobs, guaranteed essential services and the government living within its means. So what does this mean for you?

Encouraging tax cuts

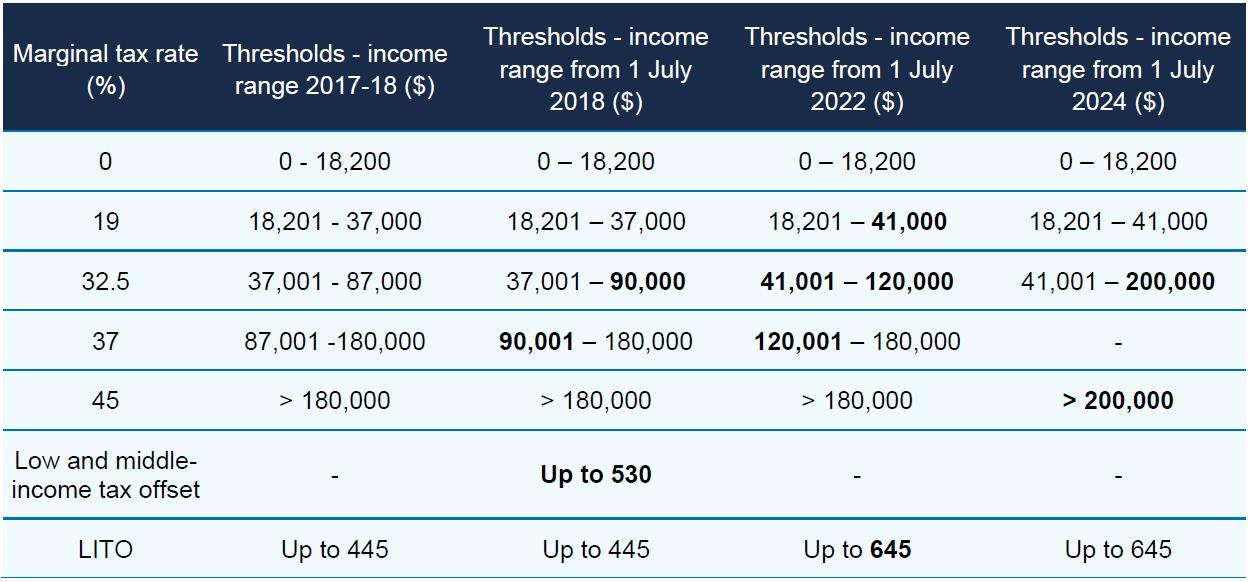

The centrepiece of the budget is income tax relief. There’s immediate relief for Australians on low to middle incomes, as well as light at the end of the tunnel for higher-income earners. Those earning up to $90,000 will get a tax cut of up to $530 via the introduction of a new, non-refundable Low and Middle Income Tax Offset from 1 July 2018. The offset will be available for the 2018-2019 to 2021-2022 income years and will be received as a lump sum on assessment after an individual lodges their tax return. The new offset is in addition to the existing Low Income Tax Offset. The new offset will provide a benefit of up to $200 for taxpayers with taxable income of $37,000 or less and for those with taxable incomes between $37,000 and $48,000 the value of the offset will increase at a rate of three cents per dollar to the maximum benefit of $530. Individuals with taxable incomes from $48,000 to $90,000 will be eligible for the maximum benefit of $530. For individuals with taxable income from $90,001 to $125,333 the offset will phase out at a rate of 1.5 cents per dollar.

Having raised it from $80,000 to $87,000 in 2017, the government is now bumping up the 37c on the dollar threshold to apply to taxable income greater than $90,000 from 1 July 2018. By 2024-25, that threshold will be eliminated and those earning $41,001 to $200,000 will face a top tax rate of no more than 32.5c in the dollar (plus the Medicare Levy), meaning Australians on high incomes will need to wait for relief.

Observation:

From 1 July 2024, individuals will pay the top marginal tax rate of 45% when their taxable income exceeds $200,000, and the 32.5% tax bracket will apply to taxable incomes of $41,001 to $200,000.

Taxation – Small business

Extension of the small business instant asset write off Proposed effective date: 1 July 2018

The government will extend the $20,000 instant asset writeoff by a further 12 months to 30 June 2019 for businesses with aggregate annual turnover of under $10 million. Small businesses will be able to immediately deduct purchases of assets costing less than $20,000 first used and installed ready for use by 30 June 2019.

Boomer benefits

As they have with every other life stage, the baby boomers look set to reinvent old age and how it is funded.

Increased work bonus

Older Australians who want to keep working can take advantage of the Pension Work Bonus being raised from $250 to $300 a fortnight, which will allow them to earn up to $7,800 per year without having their pension reduced.

The Pension Loan Scheme is also being expanded. This means many more retirees including full rate pensioners and self-funded retirees can boost their retirement income by up to $11,799 for singles and $17,787 for couples per year by borrowing against the equity they have in their home.

Aged care changes

Older Australians wanting to stay in their own homes despite confronting medical challenges, can take advantage of the additional 14,000 high-level home care packages that have been provided. There’s also more money for palliative care and mental health services for those in residential aged care.

The Pharmaceutical Benefits Scheme has received a $1.4 billion boost to list more medicines including those to treat breast cancer and relapsing-remitting multiple sclerosis.

Superannuation changes

There’s not a lot in this Budget for younger Australians but they will at least get a better deal on their super.

Measures applicable from 1 July 2018

To avoid unintentionally breaching the concessional contributions cap, individuals with income exceeding $263,157 from different employers can elect to have wages from certain employers not be subject to the Superannuation Guarantee.

Measures applicable from 1 July 2019

Administration and investment fees on accounts with balances under $6,000 will be capped at 3 per cent (of the balance). Exit fees will be banned, making it cheaper to switch super funds. The ATO will be supported to proactively consolidate any inactive super accounts a taxpayer has with their active account, where possible.

Rather than being the default option, life insurance will be offered on an opt-in basis for super fund members under the age of 25, those with account balances below $6,000, and those with inactive accounts with no contributions received in 13 months.

For individuals aged 65 to 74 with super account balances below $300,000, an exemption from the work test for voluntary contributions will be applied in the first year that they do not meet the work test requirements.

Cigs up, beer down, commutes quicker, power cheaper

In more bad news for smokers, the Government is cracking down on the sale of black-market tobacco. But Australia’s craft beer lovers may enjoy more affordable artisan ales following changes to the excise rate on small kegs.

The Government is funding infrastructure projects across the country. Among other benefits, this should result in safer, less congested roads. Australians will also benefit from the introduction of the national energy guarantee which is estimated to result in the power bill of an average household falling by $400 from 2020.

Counterfactual cost savings

Although these cost savings won’t affect the hip pocket, the measures are welcome news. The planned 0.5 per cent increase to the Medicare Levy to fund the NDIS has been scrapped. The franking credits cash refund remains. Negative gearing and the capital gains tax discount on investment properties and other investment assets have not been curbed. Furthermore, the government is funding its largesse through measures such as cracking down on welfare overpayments and targeting the black economy rather than jacking up taxes and levies on working Australians.

Having taken the GFC and end of the mining boom in its stride, Australia’s AAA-rated economy continues to power along. The Budget is even set to return to modest surplus in 2019-20 and, barring any unforeseen events, the Treasurer looks likely to achieve the goals he has set.

If you’d like more information on how the measures contained in the Budget will affect you, please give us a call.