Federal Budget Report 2020

What it means for you

7 October 2020

Changes to super, the bringing forward of tax cuts, and two lump sum payments to those on the Age Pension are just some of the Government’s proposed measures from the big spending 2020-21 Budget – released by Treasurer Josh Frydenberg on Tuesday 6 October 2020.

There’s no doubt that this year’s Budget holds particular importance in light of the events of 2020. And whilst the main focus of the proposed measures are towards creating more jobs to stimulate the economy after a record deficit, there’s plenty in the Budget for anyone who’s retired (or planning retirement) to consider too. We’ve put together this report to make sure you don’t miss any of the essential information. It’s worth noting that these proposed measures aren’t law yet – and could change.

Overview

The COVID-19 pandemic has had a profound impact on Australia’s health system, community and economy. The Government has provided $257 billion in support to cushion the economic impact of COVID-19. In doing so, the Treasurer had the unenviable task of revealing the Budget deficit will increase to $213.7 billion this year.

The focus of the 2020-21 Budget is the path to recovery with the plan focused on growing the economy so Australia can create jobs, increase economic resilience and create a more competitive and income generating economy.

From a pure financial planning and wealth perspective, the positive news from this year’s Budget is that the changes are minimal and largely positive in nature. From personal tax cuts from 1 July 2020, tax free payments for certain welfare recipient as well as some enhancements to the superannuation system, there is something for nearly everyone in this Budget. Of particular significance this year, there is no significant tinkering of our superannuation system. The rumoured changes to super guarantee arrangements has not eventuated, and there has been no further extension of the early access measure.

Below provides an overview of the measures announced in this years Federal Budget.

It is always important to remember that at this point, the Budget night announcements are only statements of intended change and are not yet law.

We will help outline what these measures may mean for you.

Summary

Age Pension

- The Government proposes to provide two $250 economic support payments to be made from early December 2020 and early March 2021 to eligible recipients.

Superannuation

- The Government will implement a ‘Your Future, Your Super’ package to improve outcomes for super fund members, comprising of four key initiatives:

– Your super follows you when you change jobs.

– By 1 July 2021, a new interactive online ‘YourSuper’ comparison tool will be available to help you decide which MySuper product best meets your requirements.

– By 1 July 2021, MySuper products will be subject to an annual performance test and if they’re underperforming, they’ll be prohibited from receiving new members.

– A strengthening of obligations on super trustees to act in the “best financial interests” of members.

Taxation

- The Government will bring forward the legislated increase in the 19% and 32.5% income tax thresholds from 1 July 2022 to 1 July 2020.

Aged care

- The Government will provide an additional 23,000 home care packages over four years from 2020-21 across all package levels.

Centrelink/Department of Veterans Affairs (DVA)

Economic support payments

The Government proposes to provide two $250 economic support payments to be made from early December 2020 and early March 2021 to eligible recipients of the following payments and concession cards:

- Age Pension

- Disability Support Pension

- Carer Payment

- Carer Allowance*

- Pensioner Concession Card (PCC)* – includes clients who have an automatic PCC because they lost the Age Pension due to the assets test changes on 1 January 2017

- Commonwealth Seniors Health Card

- Eligible DVA payments

- DVA Gold Card

- DVA Seniors Card

- Family Tax Benefit, including Double Orphan Pension*

*Only if you are not getting a primary income support payment (i.e. to avoid double $250 payments to one individual).

If you are eligible for one of the above payments/concession cards on 27 November 2020, you will be eligible for the December 2020 payment. If you are eligible for one of the above payments/concession cards on 26 February 2021, you will be eligible for the March 2021 payment.

These economic support payments are exempt from taxation and will not count as income for the purposes of any income support payment.

Pension Loan Scheme (PLS)

The Government proposes to deliver customer experience improvements for the PLS, including:

- a loan calculator to help people test their eligibility and estimate loan balances;

- electronic loan repayments;

- new online services for customers to make changes to loan terms and print or request itemised statements;

- improved access to specialist staff when customers call;

- a joint online claim for partnered customers with more relevant questions; and

- the ability for customers to complete regular loan reviews online.

This is expected to start from the end of June 2021.

Veterans

The Government proposes to simplify payment arrangements for veterans from 20 September 2022.

- This includes removing the DVA Disability Pension rent test for clients who receive Rent Assistance (RA) from DVA.

- It also includes the exemption of DVA Disability Pensions from the income test for Centrelink income support payments, which means the Defence Force Income Support Allowance (DFISA) paid by the DVA to Centrelink clients is no longer needed.

Digital skills for older Australians

The Government will provide the Be Connected Program until 2023-24 to support Australians aged over 50 to gain the skills they need to participate in the digital economy.

Pharmaceutical Benefits Scheme (PBS)

The Government has proposed a few measures regarding the PBS from 2020-21, including:

- implementing a revised and improved approach to the administration of PBS rebate receipts associated with medicines that have Special Pricing Arrangements; and

- providing over four years new and amended listings on the Pharmaceutical Benefits Scheme (PBS) and the Repatriation Pharmaceutical Benefits Scheme (RPBS).

The PBS is available for clients receiving the Pensioner Concession Card, Health Care Card, Low Income Health Care Card and Commonwealth Seniors Health Card.

If you’re overseas

The Government will provide additional support to vulnerable Australian citizens whose return to Australia has been impacted by the restrictions arising from COVID-19. The support includes loans to eligible Australians overseas to cover costs of temporary accommodation, daily living expenses and tickets for commercial flights.

For any retirees stuck overseas or with children overseas, they can register with DFAT via covid19.dfat.gov.au if they need consular assistance.

Superannuation

Superannuation reforms

The Government will implement a ‘Your Future, Your Super’ package to improve outcomes for superannuation fund members. These reforms, commencing 1 July 2021, are broken down into the following four areas:

- Your super follows you when your change jobs

Your existing superannuation account will be ‘stapled’ to you to avoid the creation of a new superannuation account if you change employment. If you have an existing superannuation account, your new employer will pay super into that existing account, unless you select another fund.

Employers will be able to obtain information about a new employee’s existing superannuation fund from the Australian Taxation Office. A second phase will be introduced from 1 July 2022 where the ATO will enable payroll systems to obtain employee superannuation details to eliminate the need for manual entry.

Where a new employee does not have an existing superannuation account and does not nominate a superannuation fund, the employer will pay the employee’s superannuation into the employer’s default superannuation fund.

- Comparing fund performance

By 1 July 2021, a new interactive online YourSuper comparison tool will be available to assist you when deciding which MySuper product best meets your requirements, by being able to compare the performance and fees of all MySuper products.

- Holding funds to account for underperformance

From 1 July 2021 MySuper products will be subject to an annual performance test conducted by the Australian Prudential Regulation Authority based on the net investment performance, with products that have underperformed over two consecutive annual tests prohibited from receiving new members until a further annual test that shows they are no longer underperforming. The annual performance test will be extended to other trustee directed APRA regulated superannuation products from 1 July 2022.

- Increasing transparency and accountability

There will be improved transparency and accountability of superannuation funds by strengthening obligations on superannuation trustees to act in the “best financial interests” of members and ensure their actions are consistent with members’ retirement savings being maximised.

Defer the start date of the Retirement Income Covenant

The Government has confirmed its deferral of the commencement of the Retirement Income Covenant, announced in Budget 2018-19, from 1 July 2020 to 1 July 2022 to allow continued consultation and legislative drafting to take place during COVID-19, and for the measure to be informed by the Retirement Income Review.

Facilitating the closure of eligible rollover funds

In response to requests from superannuation funds to provide additional time and flexibility for superannuation funds to transfer amounts to the ATO, the Government will amend the Treasury Laws Amendment (Reuniting More Superannuation) Bill 2020 to defer implementation dates of the closure of eligible rollover funds.

Previously announced COVID-19 Response Package

Temporary access to superannuation

To support individuals affected by the financial impacts of COVID-19, eligible Australian and New Zealand citizens and permanent residents were able to access up to $10,000 of their superannuation before 1 July 2020 and can access a further $10,000 from 1 July 2020 until 31 December 2020.

Temporarily reducing super minimum drawdown rates

The Government has halved the superannuation minimum drawdown requirements for account-based pensions and similar products for the 2019-20 and 2020-21 income years.

Revised start dates for Tax and Superannuation measures

The start date for the 2018-19 Budget measure to increasing the maximum number of allowable members in SMSFs and small APRA funds from four to six has been revised from 1 July 2019 to the date of Royal Assent of the enabling legislation.

The start date for the 2019-20 Budget measure ‘Superannuation – reducing red tape for superannuation funds’, which would allow SMSF trustees to choose their preferred method of calculating ECPI, and remove a redundant requirement to obtain an actuarial certificate using the proportionate method, where all members of the fund are fully in the retirement phase for all of the income year, has been revised from 1 July 2020 to 1 July 2021.

The start date for the 2015-16 Budget measure to allow the ATO to pay lost and unclaimed superannuation amounts directly to New Zealand KiwiSaver accounts, has been revised from 1 July 2016 to six months after the date of Royal Assent of the enabling legislation.

Taxation

Bringing forward the personal income tax cuts from 1 July 2022

The Government will bring forward the legislated increase in the 19% and 32.5% income tax thresholds from 1 July 2022 to 1 July 2020.

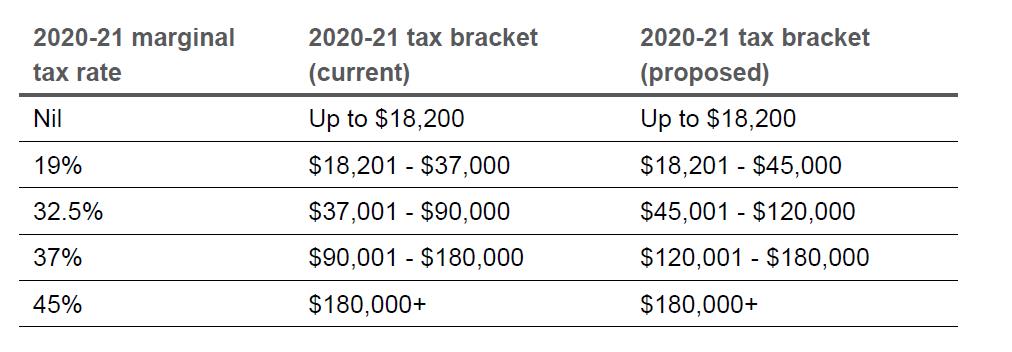

Table 1: Proposed personal income tax thresholds from 1 July 2020

The already legislated reduction of the 32.5% marginal tax rate to 30% and removal of 37% personal income tax bracket from 1 July 2024 remains unchanged.

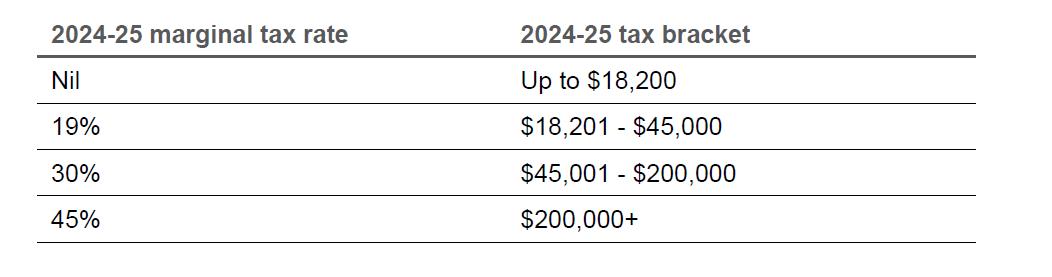

Table 2: 2024-25 personal income tax rates and thresholds

Bringing forward the increase of Low-Income Tax Offset from 1 July 2022

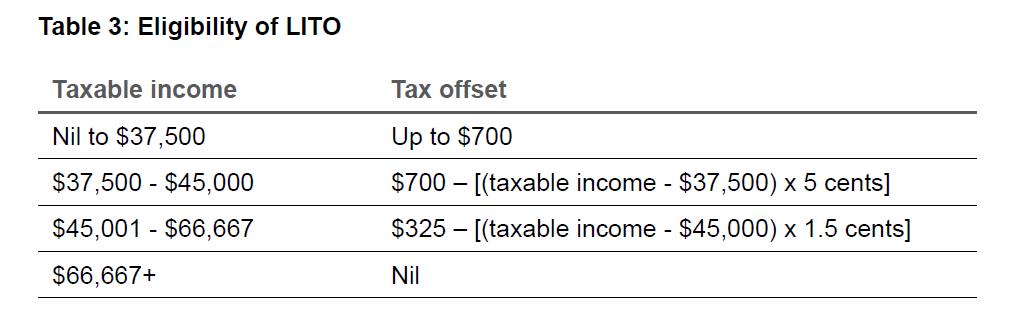

The non-refundable Low-Income Tax Offset (LITO) was legislated to increase from the current $445 to $700, starting from 1 July 2022. The legislated increase is proposed to be brought forward to 1 July 2020. As illustrated in the following table, the increased LITO will reduce for taxable income above $37,500 per annum and will cut out for taxable income above $66,667 per annum.

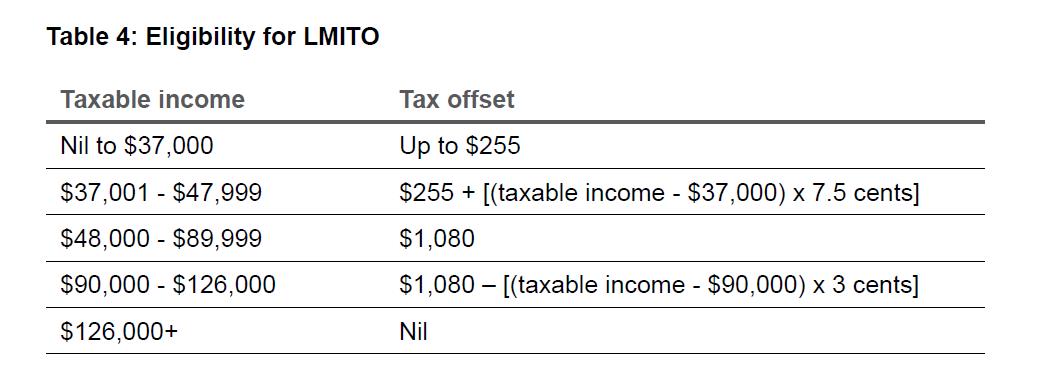

Low and Middle Income Tax Offset unchanged in the 2020-21 financial year

The Government stated that it will retain the Low and Middle Income Tax Offset (LMITO) in the 2020-21 financial year, but will not apply for 2021-22 and future years.

The LMITO will continue to be received on assessment after the individual lodges their tax return.

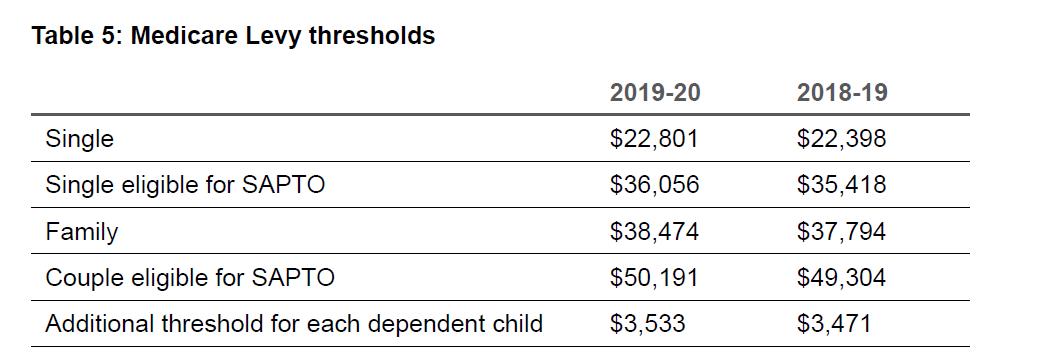

Increase to Medicare Levy low-income thresholds

The 2019-20 financial year Medicare Levy low-income thresholds will be indexed for individuals and families.

Capital Gains Tax exemption for granny flat arrangement

Currently, Taxation Ruling 2006/14 outlines the ATO’s views on potential Capital Gains Tax (CGT) implications upon a taxpayer entering, surrendering or ending life interest or granny flat types of arrangements. CGT consequences are currently an impediment to the creation of formal and legally enforceable granny flat arrangements. When faced with a potentially significant CGT liability, families often opt for informal arrangements, which can lead to financial abuse and exploitation in the event that the family relationship breaks down.

The Government will provide a targeted CGT exemption for granny flat arrangements where there is a formal written agreement. This measure is intended to remove these CGT impediments, reducing the risk of abuse to vulnerable Australians. The measure will have effect from the first income year after the date of Royal Assent of the enabling legislation.

Temporary loss carry-back provisions for business with turnover less than $5 billion

To support business cash flow, eligible companies will be able to carry back tax losses from the 2019-20, 2020-21 or 2021-22 income years to offset previously taxed profits in 2018-19 or later income years.

Companies with an aggregated turnover of less than $5 billion can apply tax losses against taxed profits in the previous years noted, generating a refundable tax offset in the year in which the loss is made.

Temporary full expensing of eligible capital assets

Business with aggregated annual turnover of less than $5 billion will be able to deduct the full cost of eligible capital assets acquired from 7.30pm AEDT on 6 October 2020 (Budget night) and first used or installed by 30 June 2022.

Full expensing in the year of first use will apply to new depreciable assets and the cost of improvements to existing eligible assets.

Businesses with aggregated annual turnover of less than $50 million can also apply full expensing to second-hand assets.

Businesses with aggregated annual turnover between $50million and $500 million can still deduct the full cost of eligible second-hand assets costing less than $150,000 that are purchased by 31 December 2020 under the enhanced instant asset write-off. These businesses will have an extra six months, until 30 June 2021, to first use or install those assets.

Businesses with aggregated annual turnover of less than $10 million can deduct the balance of their simplified depreciation pool at the end of the income year while full expensing applies. The provisions which prevent small businesses from re-entering the simplified depreciation regime for five years if they opt-out will continue to be suspended.

Qualifying business will benefit from improved cash flow, with any capital investment brought forward to benefit the greater economic recovery.

Fringe Benefits Tax – exemption to support retraining and reskilling employees

An exemption from the 47% fringe benefits tax (FBT) will be introduced for employer provided retraining and reskilling benefits provided to redundant, or soon to be redundant employees where the benefits may not be related to their current employment.

Currently, FBT is payable if an employer provides training to employees and that training does not have sufficient connection to their current employment. This measure will provide an FBT exemption for a broader range of retraining and reskilling benefits, encouraging employers to retrain redundant employees to prepare them for their next career.

The Government will also consult on allowing an individual to deduct education and training expenses they incur themselves where the expense is not related to their current employment.

Individuals cannot currently deduct education or training expenses they incur unless they are sufficiently related to their current employment. The Government will consult on potential changes to the current arrangements to determine whether deductions should also be targeted to future employment and skills needs.

Fringe Benefits Tax – reduce the compliance burden of record keeping

The Commissioner of Taxation will have the power to allow employers to rely on existing corporate records, rather than employee declarations and other prescribed records, to finalise their fringe benefits tax (FBT) returns.

FBT legislation currently prescribes the form that certain records must take and forces employers, and in some cases employees, to create additional records in order to comply with FBT obligations.

The measure will allow eligible employers to rely on existing corporate records, removing the need to complete additional records. This will reduce compliance costs for employers, while maintaining the integrity of the FBT system.

Fringe Benefits Tax – reduce the compliance burden of record keeping

The Commissioner of Taxation will have the power to allow employers to rely on existing corporate records, rather than employee declarations and other prescribed records, to finalise their fringe benefits tax (FBT) returns.

FBT legislation currently prescribes the form that certain records must take and forces employers, and in some cases employees, to create additional records in order to comply with FBT obligations.

The measure will allow eligible employers to rely on existing corporate records, removing the need to complete additional records. This will reduce compliance costs for employers, while maintaining the integrity of the FBT system.

Increase the small business entity turnover threshold

The small business entity turnover threshold will increase from $10 million to $50 million, increasing the number of businesses eligible to a range of small business tax concessions.

This measure will be implemented in three phases:

– From 1 July 2020, eligible businesses will be able to immediately deduct certain start-up expenses and

certain prepaid expenditure.

– From 1 April 2021, eligible businesses will be exempt from the 47% fringe benefits tax on car parking and multiple work-related portable electronic devices (such as phones or laptops) provided to employees.

– From 1 July 2021, eligible businesses will be able to access the simplified trading stock rules, remit pay as you go (PAYG) instalments based on GDP adjusted notional tax, and settle excise duty and excise-equivalent customs duty monthly on eligible goods under the small business entity concession. Eligible businesses will also have a two-year amendment period apply to income tax assessments for income years starting from 1 July 2021, excluding entities that have significant international tax dealings or particularly complex affairs.

Additionally, the Commissioner of Taxation’s power to create a simplified accounting method determination for GST purposes will be expanded to apply to businesses below the $50 million aggregated annual turnover threshold from 1 July 2021.

There is no proposal to change the turnover thresholds for other small business tax concessions.

Business

The Government will introduce a JobMaker Hiring Credit to incentivise businesses to take on additional young job seekers. From 7 October 2020, eligible employers will be able to claim $200 a week for each additional eligible employee they hire aged 16 to 29 years old and $100 a week for each additional eligible employee aged 30 to 35 years old. New jobs created until 6 October 2021 will attract the credit for up to 12 months from the date the new position is created.

The JobMaker Hiring Credit will be claimed quarterly in arrears by the employer from the ATO from 1 February 2021. Employers will need to report quarterly that they meet the eligibility criteria.

The amount of the credit is capped at $10,400 for each additional new position created. Furthermore, the total credit claimed by an employer cannot exceed the amount of the increase in payroll for the reporting period in question.

Eligible employees may be employed on a permanent, casual or fixed term basis and must:

- be aged (at the time their employment started) either:

- 16 to 29 years old, to attract the payment of $200 per week; or

- 30 to 35 years old to attract the payment of $100 per week;

- have worked at least 20 paid hours per week on average for the full weeks they were employed over the reporting period;

- have commenced their employment during the period from 7 October 2020 to 6 October 2021;

- have received the JobSeeker Payment, Youth Allowance (Other), or Parenting Payment for at least one month within the past three months before they were hired;

- be in their first year of employment with this employer and must be employed for the period that the employer is claiming for them; and

- not also be receiving a wage subsidy under another Commonwealth program.

Eligible employers must:

- have an ABN;

- be up to date with tax lodgement obligations;

- be registered for Pay As You Go withholding;

- be reporting through Single Touch Payroll;

- be able to demonstrate that the credit is claimed in respect of an additional job that has been created i.e. there must be an increase in the total employee headcount;

- not be claiming the JobKeeper payment.

Employers do not need to satisfy a fall in turnover test to access the JobMaker Hiring Credit.

Aged care

Additional home care packages and aged care funding

The Government will provide an additional 23,000 home care packages over four years from 2020-21 across all package levels.

The Government will also provide additional funding from 2020-21 to improve transparency and regulatory standards in aged care, including:

- continuing to reform residential aged care funding under the new Australian National Aged Care Classification system;

- maintaining the capacity of the Aged Care Quality and Safety Commission in its ongoing regulation and compliance of the aged care sector; and

- supporting the Department of Health and the Aged Care Quality and Safety Commission to respond to requests from the Royal Commission into Aged Care Quality and Safety.

Aged care COVID-19 Response Package

The Government will provide the following support for older Australians throughout the COVID-19 pandemic:

- continuing the COVID supplement in 2020-21 to assist all Commonwealth-funded residential aged care providers and home care providers with the cost of operating during the COVID-19 pandemic;

- extending the Workforce Retention Bonus Payment for two years from 2020-21 to support the direct care workforce;

- providing additional funding in 2020-21 to support residents of aged care facilities who temporarily leave care to live with their families (Emergency Leave); and • providing additional funding in 2020-21 to support the operation of the Victorian Aged Care Response Centre.