This article was developed with the team at www.vanguard.com.au

| Beating back inflation |

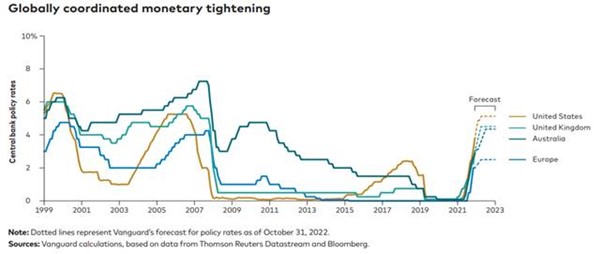

| Policy has driven conditions globally in 2022, one of the most rapidly evolving economic and financial market environments in history. One fact has been made abundantly clear: So long as financial markets function as intended, policymakers are willing to accept asset price volatility and a deterioration in macroeconomic fundamentals as a consequence of fighting inflation. Monetary policy has begun to swing toward restrictive conditions, much as it did during the 1980s though on a more coordinated scale.

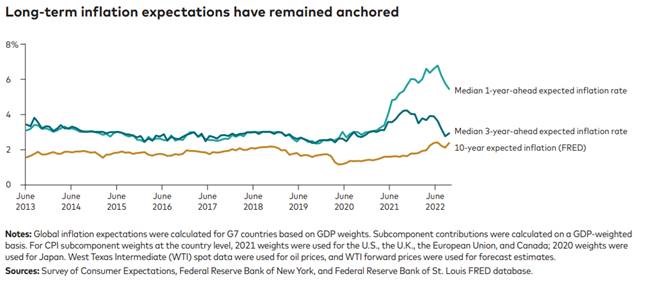

There are some similarities with the global recessions of the 1970s – relatively tight labour markets and the presence of supply-side shocks, but there are also some key differences. Rather than double-digit inflation rising ever higher and on the back of rising inflation expectations and wages, inflation expectations have largely remained anchored – especially those that look out over longer periods. Should this change, central banks will increase the urgency of their tightening process.

|

Central banks have built up credibility regarding their resolve and ability to keep inflation at target rates (i.e. the efforts to bring down inflation and maintain it around 2% for the past 30 years). The credibility gained has helped inflation remain anchored (see above) but is also the key reason why the likelihood of central banks changing their inflation targets in the middle of a high inflation environment remains low for now (as doing so could hurt their credibility to address inflation in future).

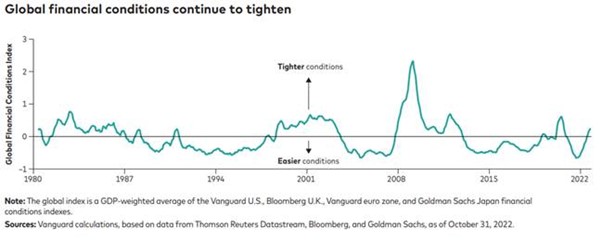

As a consequence of rising rates, global financial conditions continue to tighten, as shown in the financial conditions index below.

Employment markets remain strong with more jobs available than people to fill them, which underpins expectations for a ‘job-full’ recession, which may be relatively shallow (akin to 2001). However, some of those losing their jobs (in finance and IT) may find it more difficult to find a similar job. Offsetting this to some degree is shown in research by Vanguard’s Investment Strategy group on the impact of automation on labour markets (along with similar studies) which shows that technology and automation helps people upskill out of the ‘routine tasks’ category into the ‘interpersonal and cognitive functions’ category, where the jobs are. Upskilling also implies future productivity increases over time that would in part offset any inflationary pressures associated with higher wages.

Australia: Better placed to ride out the storm…

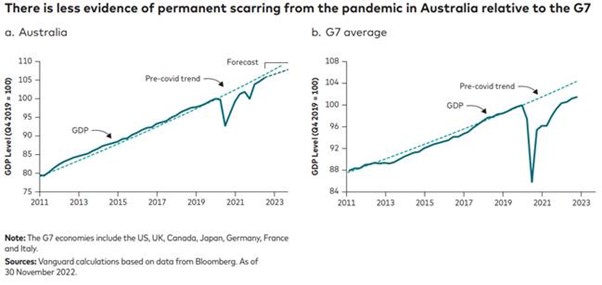

Australia has bounced back strongly from the pandemic, supported by low interest rates, generous government spending, and the release of pent-up demand which has boosted consumer spending. In fact, Australian GDP is only 1% below its pre-covid trend, suggesting only modest permanent scarring from the pandemic.

…but recession risks rising

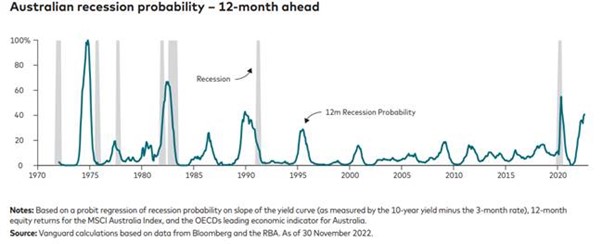

Recession probability modelling, which captures three key leading indicators of recession including the slope of the yield curve, equity market returns and leading economic indicators, is currently around 40%, suggesting that the chances of recession are material in 2023.

Despite these warning signals, Australia has a better chance than most advance economies to avoid recession. This is due to several factors.

- Australia being a net exporter of commodities and stands to benefit from surging commodity prices.

- As China relaxes zero Covid policy, Chinese activity will rebound, supporting Australian exports.

- Inflation has not reached the same levels as other advanced economies so interest rates may not need to rise as far.

- Wage growth remains modest in Australia (3.1% in September). Trade unions have failed to negotiate large wage increases for workers under enterprise bargaining agreements (which accounts for 40% of workers) so a wage inflation spiral is less likely.

Given that inflation is still well above target, expectations are the RBA to continue raising interest rates to around 4.35%. Forecasts are for inflation to peak at around 8% in coming months and fall back to 4.5% by the end of 2023.

Will there be rate cuts in 2023?

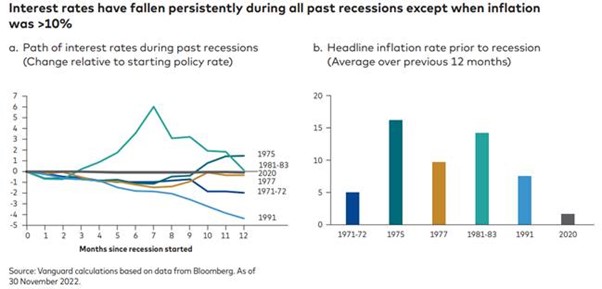

2023 will be a challenging year for the RBA, who will face a difficult trade-off between dampening inflation and averting recession. If the economy does fall into a recession the RBA may feel compelled to cut interest rates. Indeed, when we look back at recessions over the past 50 years, we observe that the RBA cut rates in every single recession (see below). Although they quickly raised rates during the recessions of 1975, 1977 and 1981-83, given inflation was at or above 10%. The key lesson we believe that the RBA took from these experiences is that cutting rates during recessions leads to even higher inflation, and an even longer battle to bring inflation back down. Consensus is that cuts are less likely in 2023.

2023 – a break in the clouds?

The stormy weather experienced by financial markets 2022 has likely unsettled even the most seasoned of investors. Indeed, the last time we saw US stocks and bonds contract more than 10% concurrently, was in the early 1800s – almost the era of Alexander Hamilton!

However, the silver lining is that both equities and fixed income are now a lot more attractively priced than where we were at the end of either 2020 or 2021. Despite the backdrop of recession in 2023 for many major economies, the good news is that the outlook for markets for the next decade is more ‘formative’.

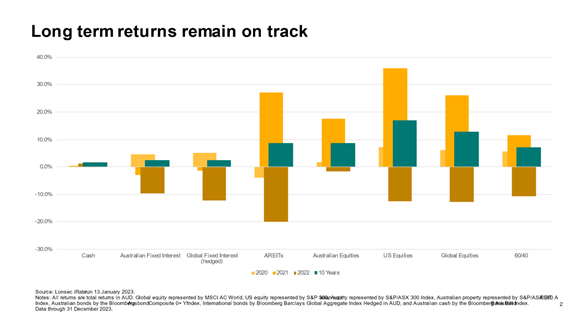

We know that in the long run, markets deliver but the journey can be bumpy. While 2022 was a challenging year it’s important to remember that 2020, even with the March 2020 volatility delivered solid gains and 2021 was quite a strong year – albeit powered by fiscal support. The chart below shows the prior three years annual calendar returns in the yellow shades, alongside the returns for the decade ending December 2022.

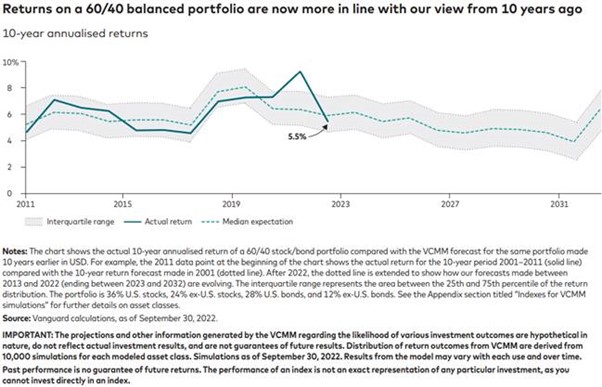

Interestingly the last decades return for the 60/40 portfolio (7.1%) are still slightly higher than the 5% to 6% range we expect for the next decade!

Global capital markets outlook

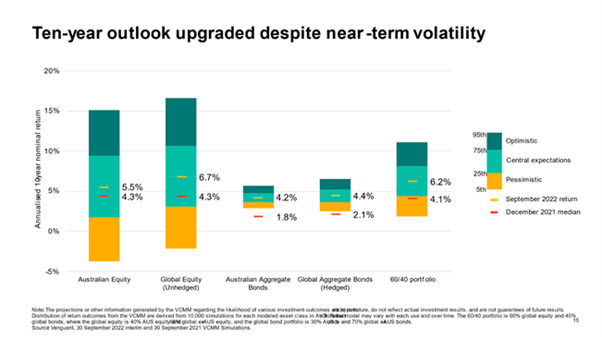

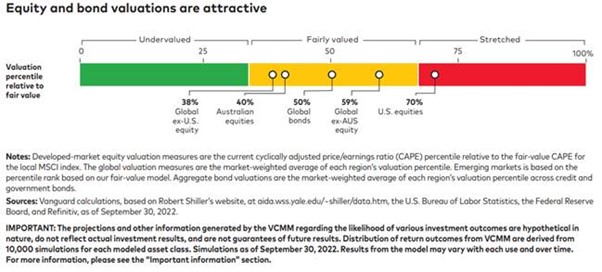

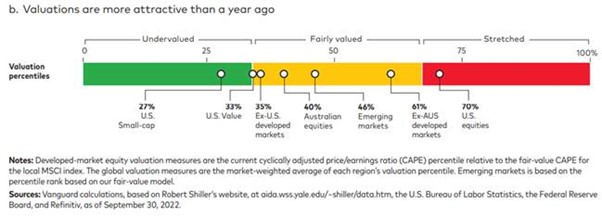

Although it is impossible to say with confidence when equity and bond markets will bottom, valuations and yields are clearly more attractive than they were a year ago. In equities, global valuations are more attractive than they were last year, but are still above the estimate of fair value in certain regions.

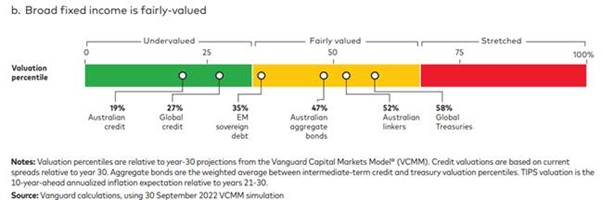

Global fixed income: Brighter days ahead

The market, which was initially slow to price higher interest rates to fight elevated and persistent inflation, now believes that most central banks will have to go well past their neutral policy rates—the rate at which policy would be considered neither accommodative nor restrictive—to quell inflation.

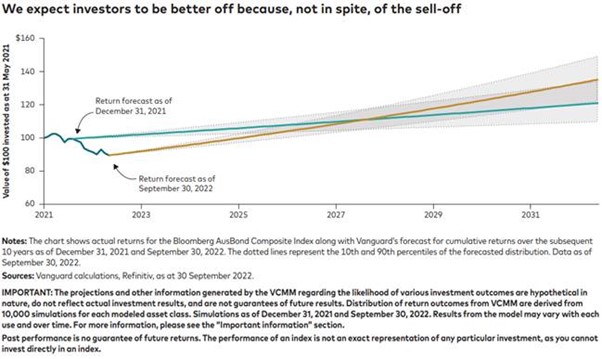

Although rising interest rates have created near-term pain for investors, higher starting interest rates have raised return expectations significantly for global bonds. Australian bonds are now expected to return 3.7%–4.7% per year over the next decade, compared with the 0.9%–1.9% annual returns forecast a year ago. For global bonds, returns of 3.9%–4.9% per year over the next decade, compared with year-ago forecasts of 1.3%–2.3%.

Vanguard’s Global Head of Fixed Income (Sara Devereaux) recently shared four things to keep in mind regarding fixed income.

- Valuations are materially better – yields are now the best they have been for a decade.

- Income is back! The healthier coupon which delivers income on bonds, underpins the stable component of fixed income returns

- Diversification benefits are also back

- During recessionary periods (like the conditions we are likely to encounter in 2023), bonds tend to do relatively well.

When interest rates rise, bonds reprice lower immediately. However, cash flows can then be reinvested at higher rates. Given enough time, the increased income from higher coupon payments will offset the price decline, and an investor’s total return should increase.

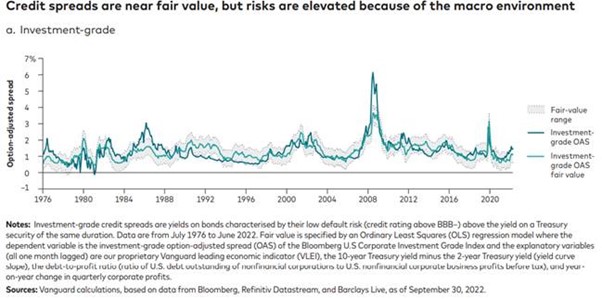

Australian and global credit attractively valued

Despite a record pace of policy tightening and a historic rise in government bond yields in 2022, credit spreads have remained remarkably resilient. Both investment grade and high-yield spreads are most sensitive to economic conditions, but the slope of the yield curve matters more for investment-grade than for high-yield, whereas, high-yield is more sensitive to corporate debt fundamentals given its riskier credit profile.

Although both investment-grade and high-yield bond spreads are within fair-value range, it is reasonable to expect that they could widen more given the outlook for weaker economic conditions, high short-term interest rates to fight inflation, and slower corporate profit growth.

Given the material increase in base government bond rates and relatively conservative positioning of Global Active Credit, it might be worth considering in 2023. Rising coupons have transformed expected return calculations and brought back the long-established use case of bonds within the context of the asset allocation of balanced portfolios.

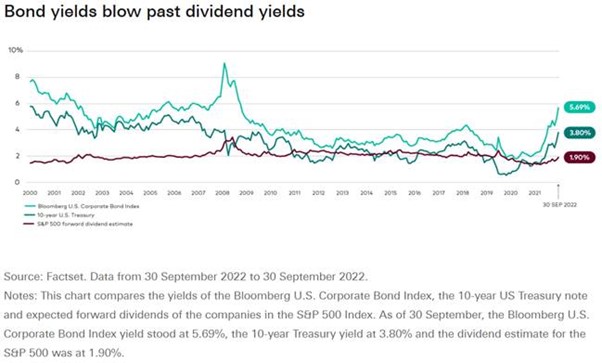

Comparing the dividend yield on the S&P 500 against the yield on US Treasuries shows just how far we’ve come this year. While many investors have implemented new, more esoteric positions in search of yield or uncorrelated assets—such as in private credit—it seems an opportune time to reconsider an old-fashioned, long-term asset allocation.

Equity valuations more favourable

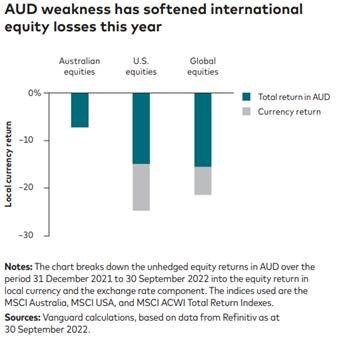

The sell-off in equity markets this year has been widespread, with many equity indexes posting losses greater than 20% in the last nine months. Valuation declines were more pronounced in U.S. markets, but a weakening Australian dollar dollar meant Australian investors realised smaller losses on their unhedged international equity exposures than suggested by local currency performance. Even though these losses are significant from a short-term, realised-return perspective, it means that the global opportunity set is now more attractive than it was a year ago.

The below shows how a stronger U.S. dollar and weaker Australian dollar have dampened losses in international equities for unhedged AUD investors. This effect has been particularly pronounced against U.S. equities, where currency movements improved AUD denominated returns by 10 percentage points. Currency returns are notoriously difficult to forecast over short investment horizons, and many factors can cause them to deviate from their fundamentals.13 However, over a sufficiently long investment horizon, we expect global inflation and policy convergence to lead to exchange-rate normalisation.

60/40 return regime back to normal(ish)?

A notable characteristic of the sell-off in global stocks and bonds in 2022 was the degree to which both fell together. 10-year outlook and realised returns for a globally diversified, 60% stock/40% bond portfolio since 2001 is shown below.

Rising equity valuations in 2021 pushed realised returns above forecasted range from 10 years prior, but large losses in both equity and fixed income over the last 12 months have brought those returns within the range. This breakdown in correlation was disconcerting for many investors and led some to question whether the 60% stock/40% bond portfolio still had merit as an investment tool. Vanguards research finds that correlations can move aggressively over shorter investment horizons but that it would take long periods of consistently high inflation for long-term correlation measures—those that more meaningfully affect portfolio outcomes—to turn positive (Wu et al., 2021).

The figure also shows that the outlook for global stocks and bonds has reversed its downward trend in the last decade. This higher return outlook is in large part because of higher interest rates to fight inflation.