Federal Budget May 2023 Summary

9 May 2023

The 2023 Federal Budget focuses on providing cost of living relief through lower power bills, higher welfare payments and more support for small business and housing.

Note: These changes are proposals only and may or may not be made law.

Cost of living

- Energy bill relief: An electricity bill credit of up to $500 will be available in 2023/24 for:

– Pensioners

– Commonwealth Seniors Health Card holders and other concession card holders

– Recipients of Carer Allowance and Family Tax Benefit A and B

– Veterans, and

– those eligible for existing State and Territory electricity concession schemes.

Eligible small businesses will receive a credit of up to $650. The amount of the credit will vary depending on the location, with no further details revealed in the Budget.

- Pharmaceutical Benefits Scheme changes: Individuals will be allowed to buy twice as many common medicines for the price of one script under changes to the Pharmaceutical Benefits Scheme from 1 July 2023. This will allow a patient access to 60 days’ worth of medicine for each script.

The change will save general patients up to $180 a year per subsidised prescription. Concession card holders are expected to save up to $43.80 a year per medicine.

- Increased bulk billing: Children under the age of 16, pensioners and other Commonwealth concession cardholders will have increased access to free healthcare under this measure, with bulk billing incentives being tripled for the most common consultations.

This includes face‑to‑face, telehealth, and video conference consultations.

- Household energy upgrades: A number of low-cost loans will be provided to access energy-saving home upgrades, such as battery-ready solar panels, modern appliances, and other energy efficiency improvements.

Superannuation

- Better targeted superannuation concessions: The Government will reduce tax concessions on certain superannuation accounts for individuals with a ‘total super balance’ (TSB) of more than $3 million (unindexed). The earnings on any balance that exceeds the $3 million threshold will be subject to an additional tax of 15% (up to 30% in total).

Individuals with a TSB less than $3 million will not be impacted by this change, and investment earnings on the accumulation balance will continue to be taxed at the maximum rate of 15%.

- Increasing the payment frequency of employer super payments: Employers will be required to pay their employees’ super at the same time as their salary and wages from 1 July 2026.

Social security

- Increase to working age payments: The fortnightly rate of JobSeeker Payment and certain other benefits will increase by $40 ($1,040 pa) on 20 September 2023.

The minimum age for the higher rate of JobSeeker Payment will also reduce from age 60 to 55 and over for those who have received the payment for nine or more continuous months. Single recipients aged 55 to 59 with nine continuous months on payment will receive an extra $99.40 pf as a result of both changes.

- Increasing Rent Assistance: The maximum rates of Rent Assistance will increase by 15% on 20 September 2023. This will provide recipients with up to $31 extra per fortnight.

- Changes to Parenting Payment (Single) Effective date: 20 September 2023. Parenting Payment for single parents of $922.10 per fortnight can be paid until the youngest child turns 14. Currently, this payment is paid to eligible single parents if their youngest child is less than eight years old.

- Increase to Home Care packages: As part of a package to improve the in-home aged care system, the Government will increase the number of Home Care packages by 9,500 in 2023/24. This may help reduce the wait time for individuals who are waiting for a package to be assigned to them.

Personal taxation

- No changes to personal income tax: The Budget did not contain any measures announcing changes to personal income tax. This includes: – no changes to the Stage 3 tax cuts which will take effect from 1 July 2024, and – no extension of the Low- and Middle-Income Tax Offset, which ended 30 June 2022.

- Increasing the Medicare levy low-income thresholds: The Government will increase the Medicare levy low-income thresholds for singles, families and seniors or pensioners from 1 July 2022. This means low-income earners will be able to earn more income before being liable to pay Medicare levy.

Small business taxation

- Small Business Energy Incentive: Small businesses with an annual turnover of less than $50 million may receive an additional 20% deduction on spending that supports electrification and more efficient use of energy.

Up to $100,000 of total expenditure will be eligible for the incentive, with the maximum bonus tax deduction being $20,000 per business. Eligible assets or upgrades will need to be first used or installed and ready for use between 1 July 2023 and 30 June 2024.

Examples of eligible assets include electrifying heating and cooling systems, upgrading to more efficient fridges and induction cooktops, and installing batteries and heat pumps.

- $20,000 instant asset write-off: Small businesses with an annual turnover of less than $10 million will also be eligible to immediately deduct the full cost of eligible assets costing less than $20,000 for assets that are first used or installed ready for use between 1 July 2023 and 30 June 2024.

Small businesses can instantly write off multiple assets as the $20,000 threshold will apply on a per asset basis.

- Lodgement penalty amnesty program. A lodgement penalty amnesty will apply for eligible small business with aggregated turnover of less than $10 million to re-engage with the tax system and get their tax obligations up to date. The amnesty applies to tax obligations, including income tax and business activity statements, that were originally due from 1 December 2019 and 28 February 2022.

If those overdue returns are lodged between 1 June 2023 and 31 December 2023, any failure to lodge penalty applying to the late lodgement will be automatically remitted. No action is required to request a remission.

The amnesty does not apply to privately owned groups, or individuals controlling over $5 million of net wealth.

Housing

- Changes to eligibility for home buyer guarantee schemes: From 1 July 2023, joint applications may be made by friends, siblings and other family members under the First Home Guarantee and the Regional First Home Buyer Guarantee. Non-first home buyers who have not owned a property in Australia in the last ten years will also be eligible.

Eligibility for the Family Home Guarantee is also expanding to include eligible borrowers who are single legal guardians of children such as aunts, uncles, and grandparents.

The number of guarantees available and other eligibility criteria are unchanged.

Legislative update

The Government has a number of measures both legislated and unlegislated in train. While not addressed in the Budget, the following is provided as a reminder of these measures.

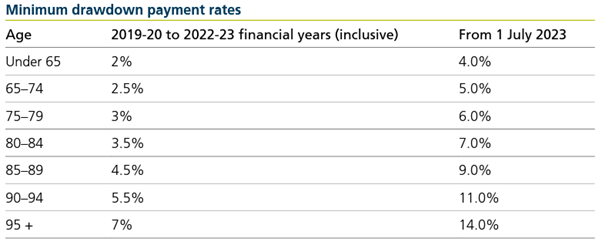

No further extension of 50% reduction to the superannuation minimum payments

No further extension of the 50% reduction has been announced to the superannuation minimum drawdown requirements for account-based income streams. As a result, the minimum will revert to the normal rates from 1 July 2023.

Indexation of the general transfer balance cap to $1.9 million

From 1 July 2023, the general transfer balance cap (TBC) indexes from $1.7 million to $1.9 million as a result of an increase to the Consumer Price Index.

Increase to the SG rate.

Effective 1 July 2023, the SG rate will increase from 10.5% to 11%. As already legislated, the SG rate is set to increase in 0.5% of gradual increments each year until it reaches 12% on 1 July 2025.