Over the past 30 years, Australians’ household debt has increased. According to the Reserve Bank of Australia, our household debt-to-income ratio has risen from 70 per cent in the early 1990s to around 190 per cent today. With numbers like this, it’s understandable that you might feel like you’ll never get out of debt. Changing your thinking around your finances, however, and learning how to make sure your money is working for you will reap great rewards. Below, we’ve outlined a few ways you can create savings while paying off debt.

Review your debt and determine what to pay off first

When you’re assessing your financial position, you first need to look at your different types of debt. The most common types of debt are credit card debt, high-interest personal loans, vehicle financing, HECS-HELP loans, and mortgages. You should focus on paying off high-interest debts first.

Review your household budget

If you don’t have a household budget, review your bank statements for the last few months and put everything into a spreadsheet. Your budget should include fixed expenses (mortgage payments or rent, bills and transport) and the money you’ll set aside for other expenses.

Eliminate unnecessary spending

When you review your spending, you’ll probably find unnecessary transactions. Identifying this unnecessary spending and adding it up will show you how much money you could put towards saving. Of course, you don’t want to feel like you’re depriving yourself and a treat each week is fine. So, set aside a small portion of your money to enjoy yourself while still living within your means.

Pay yourself first

Paying yourself first was a principle made popular in recent years in Robert Kiyosaki’s book, ‘Rich Dad, Poor Dad’. To pay yourself first, set up an automatic savings transfer to move 10% of your income straight to savings each time income hits your bank account. Once you’ve built up some savings, you could invest the capital into a balanced portfolio which will grow over time.

Use credit cards carefully

Make sure you’re using your credit card carefully and paying it off in full each month. It might seem harmless to pay the minimum, but the interest isn’t worth it.

Pay the minimum on your mortgage

It might seem responsible to make extra mortgage payments when you have the cash, but it doesn’t make your money work for you. Once you’ve paid off the minimum on your mortgage, put your leftover capital into an offset account. This will reduce the interest payable on your mortgage while allowing you to build up savings.

Pocket change savings apps

Setting up an account with a micro-investing app is another great way to save. Apps like Raiz round up your spending on purchases to the nearest dollar. It then invests your balance based on your risk appetite.

Looking at the numbers – how you can create savings while paying off debt

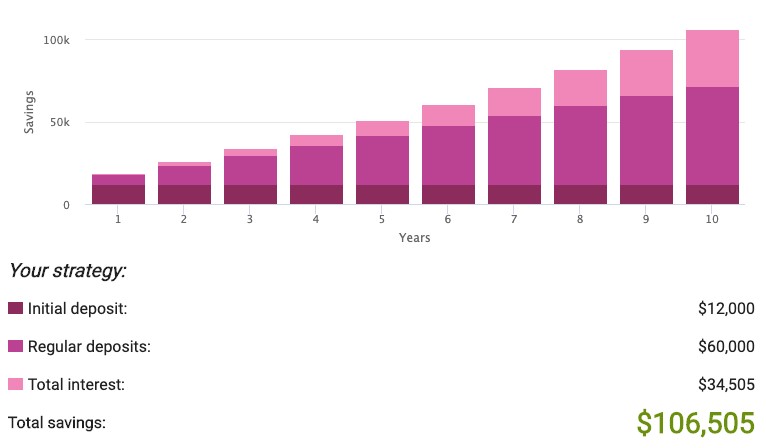

Jessica’s take-home salary is $5,000 per month. She sets up an automatic monthly transfer of $500 to her savings account. At the end of year two, she has $12,000 saved. If Jessica takes her savings balance, invests it in a low-cost fund returning an average of 7% per annum and continues depositing $500 per month, she will have a balance of approximately $106,000 after ten years. This doesn’t factor in the fact that Jessica’s income will increase over that time too. Over this time, you’ll have continued to pay-off your debt, and you’ll have built up a healthy nest egg.

Figure 1 – ASIC’s Money Smart Compound Interest Calculator: https://www.moneysmart.gov.au/tools-and-resources/calculators-and-apps/compound-interest-calculator

Consistent small actions over time lead to big results

The hard thing about debt is you often feel like you’ll never be in a comfortable financial position. It’s the small, consistent actions over time; however, that will pay great dividends in the future. Everyone’s financial situation is different, so make sure you speak to a financial adviser to discuss your unique situation and put together a strategy.