Over the past few years we have seen a significant shift in the current interest rates and expectations for future interest rates. The impacts have been far reaching – from mortgages to term deposits, the bond market, even the property market and unlisted assets which use the ‘risk free’ interest rate in valuation calculations.

For many investors, bonds feel much less familiar than term deposits. For investors looking forward, the reason that term deposits are more attractive than a few years ago is the exact same reason that bonds look attractive – higher interest rates. The key difference is that bonds are tradeable instruments which are priced according to the prevailing interest rates.

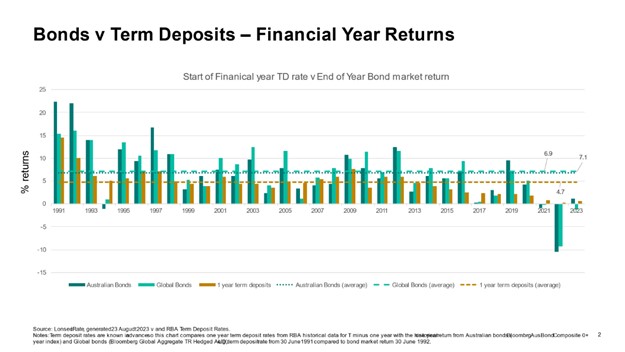

A question we have been getting of late – which is best? The answer? It depends. With term deposits you know the return you will get up front. With bonds you will not know the return until the year has concluded. In the chart below we have compared one year Term Deposit rates for $10,000 (source: RBA, Vanguard).

What about the broader portfolio perspective?

We all know that the investing in equities comes with additional risks. A portfolio invested entirely in equities has delivered a stronger return. The annualised return from January 1999 to July 2023 for a portfolio of Australian Equities was 9.2%, with a standard deviation in returns of 13.3%. A portfolio of Global Equities delivered annualised returns of 8.0% over that period (with a standard deviation of 12.1%).

By diversifying the portfolio from equities into bonds there is some give up in return – more modest 7.6%, but portfolio volatility as measured by Standard Deviation is reduced by more than half to just 5.9%. This is the power of diversification at work as bonds have the capacity to increase in value during periods of equity market volatility.

By diversifying equity exposure using cash instead of bonds, volatility is also reduced by half, but investors have foregone almost 30% return.

| Return | Risk | |

| Australian Equities | 9.2% | 13.3% |

| Global Equities | 8.0% | 12.1% |

| Balanced Portfolio (50/50 with bonds) | 7.6% | 5.9% |

| Balanced Portfolio (50/50 with cash) | 6.6% | 5.5% |

Source: Morningstar

Notes: Time period 1/1/1990 to 21/7/2023 – Australian Equities = S&P?ASX/ All Ordinaries, Global Equities = MSCI World ex Australia NR AUD, Australian Bonds = Bloomberg Aust Bonds Composite 0+, Global Bonds = Bloomberg Global Aggregate TR Hedged AUD. Balanced Portfolio = 30% Global Equities, 20% Australian Equities, 30% Global Bonds, 20% Australian Bonds. Balanced Portfolio 50/50 with cash = 30% Global Equities, 20% Australian Equities, 50% Bloomberg AusBond Bank 0+

As we near the end of the rate hiking cycle, we will reach an inflection point, where the next move in rates will be down not up. Term deposits might be good for the right now, but they may not be best for the long term.

Source Vanguard Investment Australia Ltd