22 July 2020

You, or someone you know, may have had a change in circumstances and may need support. We have put together some information to help you navigate these uncertain times and to answer some frequently asked questions.

Note: The following outlines the original JobKeeper payment as well as the extension announced by the Government on 21 July 2020. The changes to the payment under the extension applies from 28 September 2020 to 28 March 2021. Legislation still needs to be passed to support the extension of the payment to March 2021.

Q: What is JobKeeper payment?

The JobKeeper payment fortnightly payment per eligible employee of a business. The amount is paid to the employer and is designed to assist employers to continue paying their employees.

The rate of JobKeeper is currently $1,500 (gross) per fortnight until 27 September 2020 for all eligible employees. After this time, tiered rates will be introduced as follows:

- From 28 September 2020 – 3 January 2021:

– $1,200 per fortnight for those working 20 hours or more per week (on average)

– $750 per fortnight for those working less than 20 hours per week.

- From 4 January to 28 March 2021:

– $1,000 per fortnight for those working 20 hours or more per week (on average)

– $650 per fortnight for those working less than 20 hours per week.

The assessment of hours is based on the four weeks prior to 1 March 2020. The ATO has discretion to assist in determining alternative approaches to determining hours in certain circumstances.

Q: What if the employee’s income is less than the relevant rate per fortnight payment?

A payment equal to full amount of JobKeeper must be made to eligible employees. This means that if an employee’s gross fortnightly earnings are less than the amount of JobKeeper received by the employer, the employee will receive an additional amount.

This includes where the person’s hours have been significantly reduced, or the person has been stood down temporarily.

At the current rate, if an employee’s ordinary gross fortnightly earnings are less than $1,500, this employee receives increased fortnightly payments from their employer equal to the JobKeeper payment.

For example, if an employee usually earns $1,000 per fortnight and the employer receives the JobKeeper payment, then the employee receives their usual salary of $1,000 plus an additional $500.

Q: What if the employee’s income is more than $1,500 per fortnight?

An employee must be paid for work completed. This means that if a person is continuing to work (including reduced hours), but their fortnightly income due for work completed still exceeds the JobKeeper payment, the employer must pay them for the work that has been done. The JobKeeper payment will assist the employer paying for the employee’s salary.

Eligible employers

Q: Who is an eligible employer?

All business types, including sole traders, companies, trusts and partnerships, provided that it is not in bankruptcy or subject to the major bank levy.

An employer is eligible if the business has turnover of:

- less than $1 billion which has reduced by more than 30%, or

- more than $1 billion which has reduced by more than 50%.

Charities registered with the Australian Charities and Not-For-Profit Commission are eligible where turnover is estimated to have fallen or is likely to fall by 15% or more.

Currently, the test compares at least a month compare to a year early. However, the comparison will relate to the relevant corresponding quarters in the previous year when determining eligibility from 28 September to 28 March 2021.

Q: Are there any specific rules in relation to a partnership, trust or company receiving JobKeeper?

Where a business is run as a partnership, only one partner will be eligible to receive JobKeeper. Other employees of the partnership may be eligible, however, partners are not employees for this purpose.

Trusts are able to receive JobKeeper for all eligible employees. However, where beneficiaries receive only passive distributions, JobKeeper is only payable to a single nominated beneficiary. Under a company structure, directors are treated as employees in a number of circumstances. However, only one director is eligible to receive the JobKeeper payment. This director must be nominated.

Under a company structure, if only dividends are paid to shareholders who also provide labour for the business, one nominated shareholder is eligible to receive the JobKeeper payment. This may arise if you run your business through a company structure and only receive dividends as income rather than drawing a salary from your company.

Q: Are there any specific rules in relation sole traders receiving JobKeeper?

A sole trader that is carrying on a business may be eligible to receive JobKeeper. If the sole trader also employs other people, additional JobKeeper payments may be claimed for each eligible employee.

However, a sole trader who operates more than one business can only receive JobKeeper once. A sole trader can’t receive the JobKeeper payment for their business if they are a full or part-time employee of another business eligible for JobKeeper payment. This excludes casual employment. If they are a long-term casual of the other business, they will need to let that employer know if they will claim the JobKeeper payment through their employer or whether they will apply for JobKeeper as a sole trader, but they cannot claim both.

Q: How is turnover calculated?

Turnover is calculated in line with the GST rules (with some modifications for businesses that are part of a GST group). Australian GST law doesn’t apply to overseas sales, and therefore any reduction in foreign operations will not be considered when determining whether or not the turnover test is met.

Until 28 September 2020, to work out your fall in turnover under the ‘basic test’ you’ll need to identify the ‘turnover test period’. This could be either a monthly or quarterly turnover period and isn’t determined by the timing of your reporting.

If you’re enrolling and applying for JobKeeper from commencement, this test period could be either the month of March or April 2020 (via a comparison to the same month in 2019), or your projected turnover for the April 2020 quarter (compared to turnover in the April 2019 quarter).

If you enrol and apply for payment at a later date, you would then use turnover or projected turnover for a later period. However, once eligible, the entitlement to the JobKeeper payment under the turnover test will continue until 27 September 2020.

The turnover test will change from that time as follows:

- From 28 September 2020 to 3 January 2021, actual GST turnover in both the June and September 2020 quarters compared to the corresponding quarters in 2019.

- From 4 January to 28 March 2021, actual GST turnover in each of the June, September and December 2020 quarters compared to the corresponding quarters in 2019.

The change means that businesses will need to show a continued significant downturn in turnover. For more detailed information on the turnover test calculation, see ato.gov.au.

Q: Can the turnover test be met where a business wasn’t in operation a year ago, or has ‘lumpy’ income?

If business income at a comparable time a year ago isn’t representative of current turnover, discretion may be applied by the ATO to determine eligibility under the ‘alternative test’. This may apply in circumstances where an ‘out of the ordinary’ event occurred during the relevant comparison period, meaning that it wouldn’t be an appropriate comparison. The ATO has indicated that this may include circumstances where the business is newly established, has undergone significant structural changes, or suffered through an environmental event (such as drought).

Additional information and evidence will need to be provided for consideration, to help the ATO determine whether the business has been adversely impacted by the coronavirus pandemic.

For more detailed information on alternative approaches to the turnover test, see ato.gov.au.

Q: What if turnover hasn’t yet dropped by 30%, but does so during the coming months?

Where a reduction in turnover of 30% or more is reasonably expected, the ATO may accept an application for JobKeeper at a later date. However, the business must have enrolled to be eligible to receive the payment from that particular fortnight. The ATO has provided some further guidance about how self-assessment in relation to an anticipated fall in turnover should be completed.

Where a reduction of 30% in turnover cannot be reasonably expected at the current time, a business may be eligible to apply for JobKeeper payments at a later time if they do see a 30% reduction in turnover. In this case, the JobKeeper payment is not backdated to the commencement of the scheme, but is payable from date of eligibility until 27 September 2020.

From 27 September 2020, an actual fall in turnover must be demonstrated, as outlined previously.

Eligible employees

Q: Who is an eligible employee?

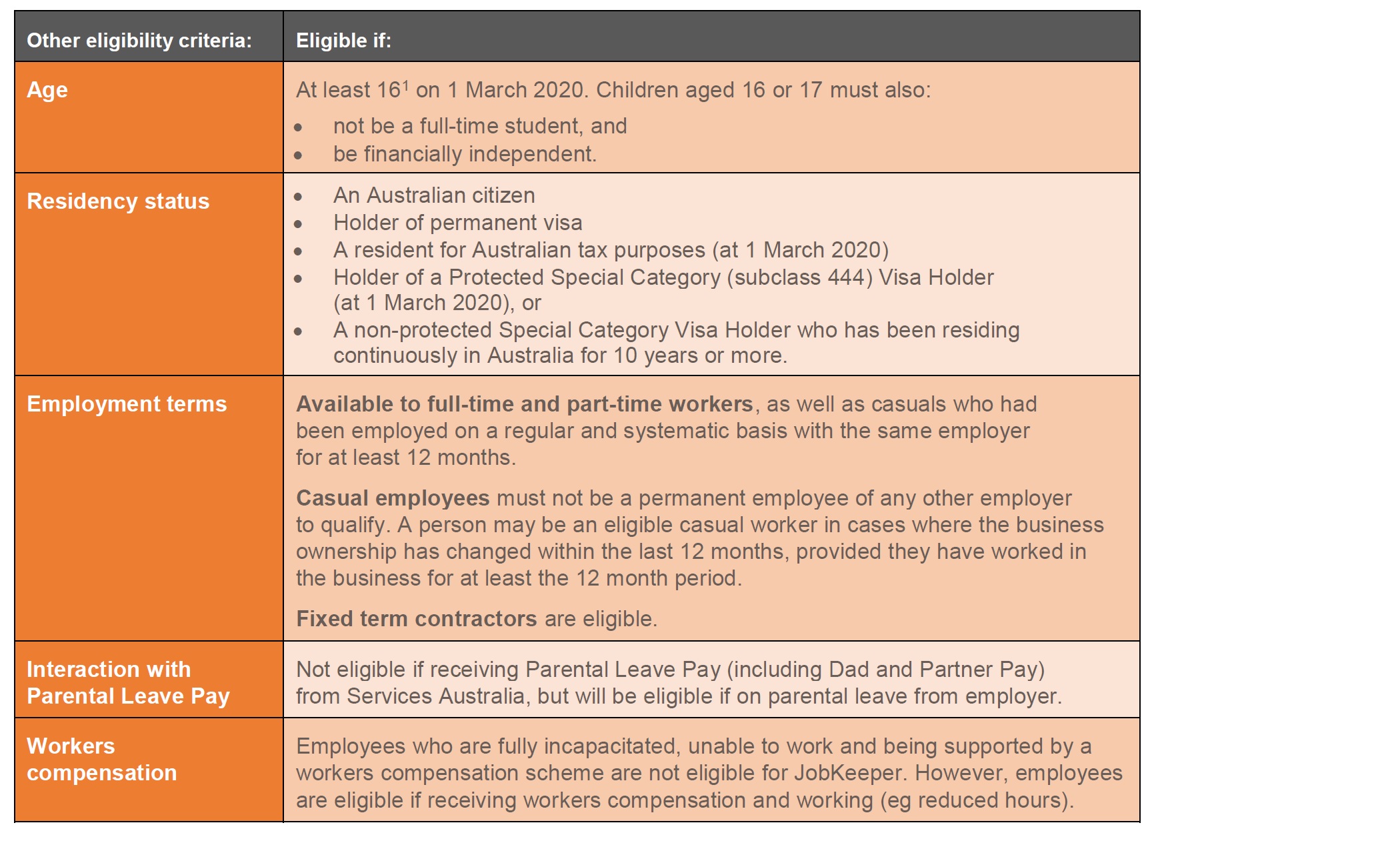

The payment is available for each employee who was on the books as at 1 March 2020 and who is retained, or continues to be engaged. This includes those who have been stood down or let go if the person is subsequently rehired (even if they are immediately stood down again after JobKeeper commences), as long as they were also on the books and a resident for Australian tax purposes, on 1 March.

Where employees have been made redundant and there is an opportunity to be re-engaged, the employer is encouraged to discuss the terms or redundancy with the person and to consider workplace arrangements to determine redundancy terms.

Q: Are children under 18 eligible to receive JobKeeper payment?

The rules were amended to exclude children aged 16 or 17 on 1 March 2020 from being an eligible employee to receive the JobKeeper payment if the child is also:

- a full-time student, and

- not financially independent.

Initially, a child aged 16 or 17 on 1 March 2020 would be an eligible employee for JobKeeper payment if they were a permanent employee or long-term casual of an employer that qualified for JobKeeper.

Importantly, the amendments only apply to JobKeeper fortnights from 11 May and eligibility will not be impacted retrospectively. This means that employers are required to pay JobKeeper payments received to eligible children during the first three JobKeeper fortnights.

Q: If an employee has more than one eligible employer, which employer does the employee receive the JobKeeper payment from?

If an employee is a permanent employee of more than one eligible employer, the employee should contact their employers and nominate one employer that they will receive the JobKeeper Payment from. However, if a person has a permanent role and also a casual role with two eligible employers, they must nominate the employer they have a permanent position with.

Q: Is super guarantee payable on JobKeeper payments?

Compulsory super contributions (ie super guarantee) are not payable on amounts of JobKeeper received by the employee that exceed their usual fortnightly wage or salary. This means if an employee is now receiving more than their usual salary because of the JobKeeper payment, an employer only has to pay SG on the employee’s usual salary amount. Any additional super contributions by the employer would be voluntary. On the other hand, where the employee’s usual salary is only partially subsidised by the JobKeeper payment because their ordinary earnings exceed the JobKeeper amount, the employer is liable to pay superannuation guarantee on the full amount paid to the person.

It is not yet understood how this will be determined for eligible casual workers whose fortnightly hours were subject to fluctuation.

Q: If an employee who has been stood down and is receiving JobKeeper starts work with another employer, can JobKeeper continue to be received and paid to the person?

Yes. There is no income test applicable to JobKeeper payment. However, the new employer can’t claim the JobKeeper for the person. This is because an employee is only eligible to receive the JobKeeper payment from one employer.

Q: If a person is on paid or unpaid leave can JobKeeper be paid?

Yes. JobKeeper will be paid, unless the leave is Parental Leave or Dad and Partner Pay paid via Services Australia.

Q: If a person receiving JobKeeper had an existing salary sacrifice arrangement with their employer can it continue?

Yes. These arrangements can continue. The JobKeeper payment can be paid to an employee as cash, fringe benefit or additional super contributions. However, how the payment is received must be agreed to between the employer and employee.

Taxation and Centrelink

Q: How is the payment treated for social security purposes?

JobKeeper payment is treated as ordinary income for social security purposes and may impact eligibility for income support. This may include Child Support, Family Tax Benefit and Child Care Subsidy. Services Australia must be notified if a person is receiving any payment or benefit and starts receiving JobKeeper.

Q: Can an employee be receiving both JobKeeper and the JobSeeker Payment from Centrelink?

Because the JobKeeper payment is assessable for social security purposes, individuals who receive a social security payment or benefit and start to receive JobKeeper will need to report any change in their income to Centrelink within 14 days. This can be done through my.gov.au, the Express Plus Centrelink App or contacting the Department directly.

The current income test cut off point for JobSeeker payment is $1,088.50 2 pf for a single person with no dependants. This means that a single person receiving JobKeeper is effectively ineligible for JobSeeker payment due to the income test.

For more information on the income test cut off points for JobSeeker, see the Services Australia website.

Q: How is the payment treated for tax purposes?

The payment is taxable income of the employee and employers may have withholding tax obligations.

Application and ongoing requirements

Q: How and when can an eligible employer enrol for JobKeeper?

Enrolments commenced on 20 April 2020 but business can enrol at any time. Eligible employers or their registered tax or BAS agent can enrol for the JobKeeper payment via the ATO Business Portal. Employers can log in using their myGovID, select ‘Manage employees’ to find the link to JobKeeper payment, where employers can find and fill in the JobKeeper enrolment form.

Q: What does a business without employees (eg sole trader) need to do?

Employers without employees can enrol through ATO Online Services via myGov or the Business Portal using myGovID. They will need to provide the business’ ABN, provide a declaration on recent business activity, nominate the person to receive the payment and confirm their details. Payments will be directed to that person’s bank account. On a monthly basis, the business will need to reconfirm the nominated person to the ATO and that they are still eligible to receive the payment.

Q: What do eligible employers need to do for the enrolment process?

Employers must identify all eligible employees, including any employees stood down and those that have since been rehired. This is done using the Single Touch Payroll (STP) system. Where this system does not have functionality for JobKeeper in-built or is not used, this process can be done through the ATO Business Portal or myGov.

Once all employees are identified, the employer must notify the eligible employees of their nomination for JobKeeper payment and ensure they are not claiming JobKeeper from another employer.

The JobKeeper employee nomination notice needs to be provided to all nominated eligible employees, which must be completed and returned to the employer.

Q: What else does a business have to do to continue to receive payments?

Payments need to be reported to the ATO using STP where applicable. Payments will be made by the ATO monthly in arrears and the employer must report to the ATO monthly to demonstrate that payments have been made to employees. Records must be kept by employers for five years after payments are made.

The number of eligible employees nominated for the JobKeeper payment must be reviewed for each fortnight and if there are changes due to an employee leaving or being terminated, this must be updated and the ATO notified to avoid an overpayment (which would need to be repaid).

On a monthly basis, employers need to reconfirm their nominated eligible employees via a business monthly declaration report. Employers must notify of any eligible employees leaving the employer or changing their employment and also provide updates on current and projected GST turnover through this report.

Monthly reporting of GST turnover is intended to provide indications of business progress and is not an ongoing test of eligibility for JobKeeper.

Q: Can an employer receive JobKeeper for an employee as well as the Apprentice and Trainee wage subsidy?

No. Employers may be eligible to receive the Apprentice and Trainee wage subsidy for the period from 1 January to 31 March 2020. However, they will be ineligible from 1 April 2020 when they will receive JobKeeper for the employee.

1 Children who were aged 16 or 17 on 1 March 2020 that are full-time students and/or are not financially independent are not eligible for JobKeeper Payments from 11 May 2020, but will be able to keep any JobKeeper payments made in the first three JobKeeper fortnights.

2 Rate is current from 1 July 2020 and excludes proposed changes announced to income test from 25 September 2020.