We’d all love to be self-funded in retirement, but for many of us it’s simply not possible. Sometimes we can partially self-fund, sometimes not at all and this is where the government provides assistance.

Depending on your circumstances, you may be eligible for either a part or full age pension, but the Australian age pension system is notoriously complex.

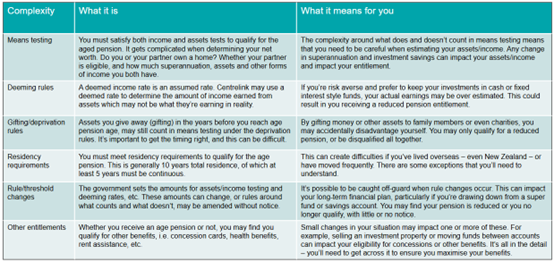

When trying to understand your eligibility, it’s easy to become confused by questions around means tests, deeming rules, residency requirements etc, making it difficult to understand how much, if anything at all, you’re entitled to receive.

Here’s a round-up of the complexities seniors tend to struggle with the most.

Despite the complexity of the age pension rules, you can take steps to make things easier.

- Do your research

Australian government free online resources like MoneySmart and Centrelink’s Financial Information Service provide information to help you understand your entitlement and the rules. There is even a quick calculator that will provide a rough estimate of your entitlement.

Note that these sites can only provide general information, and can’t answer questions specific to you and your situation.

- Seek professional advice

We can provide up-to-date information around your age pension entitlement. We can answer questions specific to you and your circumstances, and importantly, guide you in structuring your investment portfolio to maximise your entitlement.

- Stay informed

Magazines, blogs and community groups dedicated to seniors and retirees are highly beneficial. They’ll keep you updated about issues that directly affect you and your lifestyle, including budgeting and financial news.

Upon reaching age pension age, you’ve probably either already retired, or you’re about to. It’s a busy time, and with so much to think about, so many issues and questions you’ve previously not had to deal with, it’s easy to feel overwhelmed.

Additionally, dealing with government departments can be daunting and time consuming, so you’ll want to get things sorted with as little to-ing and fro-ing as possible. We will be able to provide information about your entitlement and can assist with some of the paperwork.

While the age pension is certainly complicated, you don’t have to figure it out alone. The right support will help you achieve your well-earned peace of mind and financial security in retirement.