The first quarter of 2024 saw the Government roll out considerable changes to the Stage 3 Tax Cuts, inflation continuing to slow but remaining stubbornly high across some areas, surging stock market highs and continuing pressures in the property sector.

Government Overhauls Stage 3 Tax Cuts

In January, the Labor government unveiled changes to the proposed stage 3 tax cuts, aimed at providing bigger tax cuts to middle Australia. The new changes, which passed the Senate to become law in February, retain the tax bracket that would have been scrapped under the original proposal, and adjust tax rates to benefit both lower and higher-income earners.

The changes will take effect from July 1 and are summarised as follows:

| Taxable Income Bracket | Tax rate | |

| New Tax Plan from July 1, 2024 | Below $18,200 | 0% |

| $18,200 to $45,000 | 16% | |

| $45,000 to $135,000 | 30% | |

| $135,000 to $190,000 | 37% | |

| Above $190,000 | 45% | |

| Original Stage 3 tax cuts | Below $18,200 | 0% |

| $18,200 to $45,000 | 19% | |

| $45,000 to $200,000 | 30% | |

| Above $200,000 | 45% |

Inflation continues to ease

Inflation continues on a downward trend, with the RBA expecting it to return to the target range of 2-3 percent in 2025, and reach the midpoint in 2026.

Service price inflation remains high despite goods price inflation decreasing, supported by continued excess demand and strong domestic cost pressures.

The RBA expects the consumer price index (CPI) to come in at 3.3% by June, compared with 3.9% forecast three months ago. As a result, the board decided to leave the cash rate unchanged at 4.35 per cent at the first official meeting for the year.

Share Market Highs

Global share markets have been breaking records this quarter, with the ASX200, S&P500, Eurozone and Japanese markets reaching record highs, helped by US inflation data coming in as expected, leaving the Fed on track to cut rates from mid-year.

Whilst economic growth both locally and globally is forecast to slow, there is optimism in the market as inflation has started easing and is likely to continue falling, and central banks across the US, Canada and Europe are expected to start cutting rates in the coming months. Recession still looms as a risk, but it appears the economy may be moving toward a soft landing.

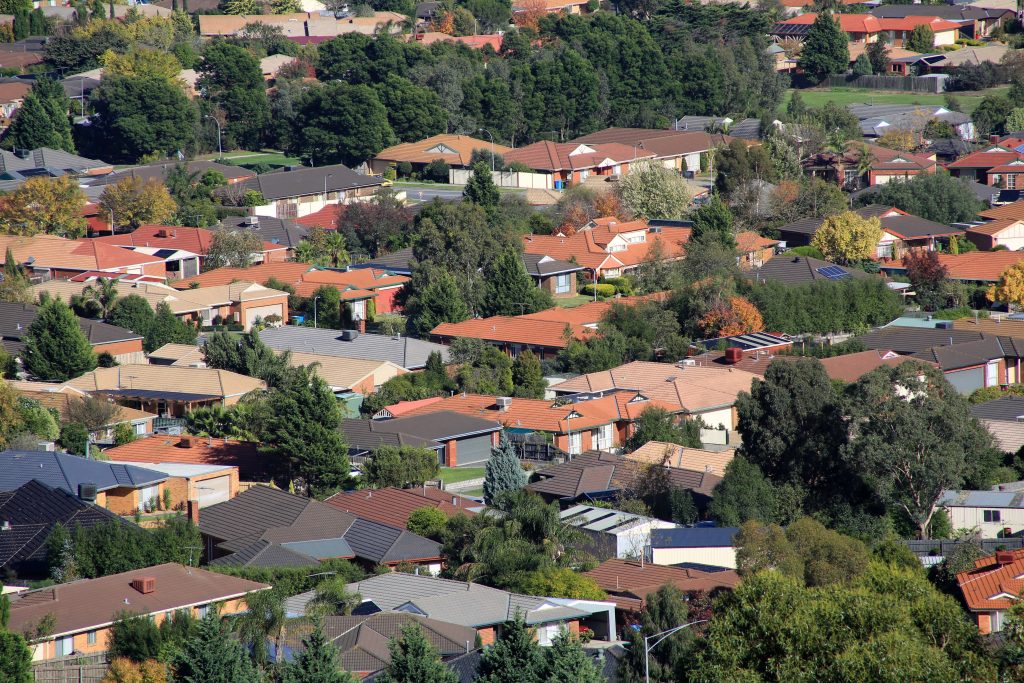

Housing market continues to tighten

The national vacancy rate fell to a new low of 0.7 per cent in February, highlighting the ongoing supply and demands challenges in rental properties across Australia, as a result of a construction sector under strain, rapid population growth from migration, and rising property prices.

Whilst the government has put stricter measures on international students to try to ease demand pressures, supply continues to be an issue, with building approvals falling by 1 per cent in January, though multi-unit dwelling approvals increased by 19.5 per cent in the same period.

Property prices continued to rise despite higher interest rates, inflation and cost of living concerns. The Home Value Index was up 0.6 per cent nationally in February, and showed an increase in all capital cities except Hobart.

Labour market cooling

Labour market conditions cooled over the December quarter 2023, with an ongoing shift away from full-time employment and growth in part-time jobs, and a decrease in recruitment activity. These trends are consistent with Treasury forecasts that growth will continue to ease and the unemployment rate will increase from 3.9 per cent in January to 4.2 per cent by June, and 4.3 per cent by the end of the year.

Despite clear softening, labour market conditions remain tight, and many employers are experiencing challenges finding suitable workers to fill positions, while some shortage pressures remain evident.