Introduction

The Government is acting decisively in the national interest to support households and businesses and address the significant economic consequences of the Coronavirus (COVID-19)

The response targets two areas;

- Individuals and households

- Support for businesses

For retirees on Centrelink, much of this will be processed as part of your payment. Remember if your situation has changed and you feel that Centrelink records or not accurate, please contact Centrelink.

For workers that have been affected, contact Centrelink to ensure you receive what you are entitled to.

Remember, please follow the advice – if you have a phone or can get online – do that.

Do not go to Centrelink if you can use the phone or internet.

For business owners, work with your accountant to ensure you are getting what you are entitled to.

Below is a summary of the issues that may impact you. This is changing daily and may vary between states.

Individuals and households

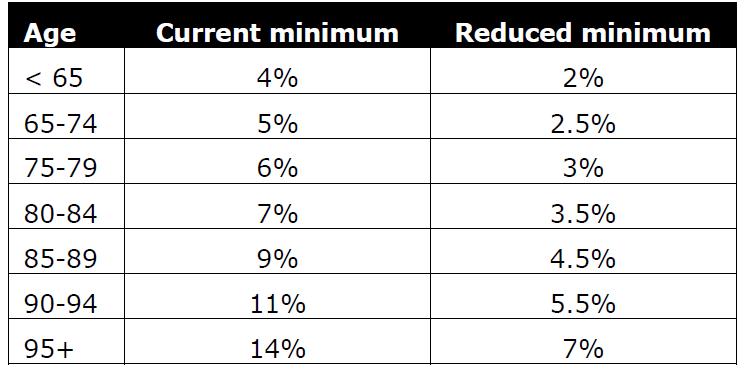

Reducing ABP minimum drawdowns

The minimum drawdown requirements for Account-Based Pensions (ABPs) and similar products will be reduced by 50 per cent. The reduction will apply for the current income year (2019-20) and the 2020-21 income year.

If you have already drawn the reduced minimum in the current income year you will not be required to take any additional payments. However, from a practical perspective you may need to contact their fund to confirm you wish to reduce their pension payments accordingly.

While this announcement will allow people to reduce their pension payments to preserve capital this will depend on their ability to meet their ongoing living costs. In this case, it will be important to consider the Government’s other stimulus announcements in relation to additional payments and changes to deeming rates.

Early access to superannuation

From mid-April 2020, eligible individuals will be able to access up to $10,000 of their superannuation before 1 July 2020. They will also be able to access up to a further $10,000 from 1 July 2020 for approximately three months (exact timing will depend on the passage of the relevant legislation).

The Government has confirmed the payments will be tax-free and will not impact a member’s Centrelink or DVA entitlements.

It is important to note that the Government has confirmed that members will only be permitted to make one application each income year.

For example, if a member accessed $6,000 in May 2020, they will not be permitted to make an additional application to release an extra $4,000 before the end of the year.

Eligibility

To be eligible for early release a member must satisfy any one or more of the following requirements:

- they are unemployed, or

- they are eligible to receive a Jobseeker Payment, Youth Allowance for jobseekers, Parenting payment (which includes the single and partnered payments), Special Benefit or Farm Household Allowance, or

- on or after 1 January 2020:

- they were made redundant, or

- their working hours were reduced by 20 per cent or more, or

- if they are a sole trader — their business was suspended or there was a reduction in their turnover of 20 per cent or more.

Note – It is not exactly clear how working hours or turnover will be determined at the time of writing, however the example in the relevant Government factsheet indicates that if a person’s hours or turnover in a month reduce by more than 20% compared to their average hours or turnover over the last six months of 2019, they will be eligible.

How to apply

Members will need to apply for the early release of their benefits directly to the ATO through the myGov website: www.my.gov.au.

Once the ATO has processed the application it will issue a determination to the member and a copy to their fund. The member will not need to apply directly to their super fund.

Note – separate arrangements will apply for members of self-managed superannuation funds. Further guidance will be available via the ATO website.

The Government expects members will be able to start applying through myGov from mid-April 2020.

$750 support payments

The Government is providing two separate $750 payments to social security, veteran and other income support recipients and eligible concession card holders.

The first payment will be paid automatically from 31 March 2020

- The second payment will be paid automatically from 13 July 2020

An individual can be eligible to receive both the first and second payment. However, they can only receive one $750 payment in each round of payments.

The payment will be exempt from taxation and will not count as income for the purposes of Social Security, Farm Household Allowance and Veteran payments.

Eligibility for the first $750 payment

To qualify for the first payment, an individual:

- must be residing in Australia, and

- must be receiving one of the following payments, or hold one of the following concession cards, at any time from 12 March 2020 to 13 April 2020, inclusive (or have lodged a claim during this period and the claim is subsequently granted):

- Age Pension

- Disability Support Pension

- Carer Payment

- Parenting Payment

- Wife Pension

- Widow B Pension

- ABSTUDY (Living Allowance)

- Austudy

- Bereavement Allowance

- Newstart Allowance

- JobSeeker Payment

- Youth Allowance

- Partner Allowance

- Sickness Allowance

- Special Benefit

- Widow Allowance

- Family Tax Benefit (including Double Orphan Pension)

- Carer Allowance

- Pensioner Concession Card (PCC) holders

- Commonwealth Seniors Health Card holders

- Veteran Service Pension; Veteran Income Support Supplement; Veteran Compensation payments, including lump sum payments; War Widow(er) Pension; and Veteran Payment.

- DVA PCC holders; DVA Education Scheme recipients; Disability Pensioners at the temporary special rate; DVA Income support pensioners at $0 rate.

- Veteran Gold Card holders

- Farm Household Allowance

Eligibility for the second $750 payment

To qualify for the second payment, an individual must meet the following criteria on 10 July 2020:

- must be residing in Australia, and

- must be receiving one of the payments or hold one of the concession cards that were eligible for the first payment, except for those who are eligible to receive the Coronavirus supplement.

Individuals who are eligible to receive the Coronavirus supplement are not eligible for the second $750 payment. Please refer to the ‘Coronovirus supplement of $550 per fortnight’ section in this Blog for more information.

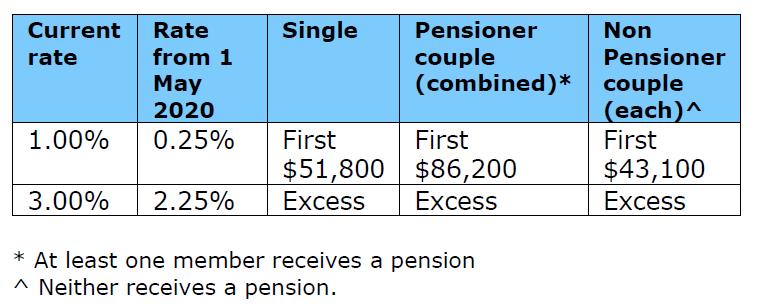

Reduction in deeming rates

On 12 March 2020, the Government announced a 0.5 percentage point reduction in both the upper and lower social security deeming rates. The Government will now reduce these rates by another 0.25 percentage points.

As of 1 May 2020, the deeming rates listed in the table below will apply:

Coronavirus supplement of $550 per fortnight

From 27 April 2020, the Government is establishing a new, time-limited Coronavirus supplement to be paid at a rate of $550 per fortnight.

This supplement will be paid to both existing and new recipients of the following eligible payment categories:

- Jobseeker Payment (and all payments progressively transitioning to JobSeeker Payment including those currently receiving Partner Allowance, Widow Allowance, Sickness Allowance and Wife Pension)

- Youth Allowance Jobseeker

- Parenting Payment (Partnered and Single)

- Farm Household Allowance

- Special Benefit recipients

Anyone who is eligible for the Coronavirus supplement will receive the full rate of the supplement of $550 per fortnight.

These changes will apply for the next six months.

Note – people that qualify for the Coronavirus supplement will not be eligible for the second $750 stimulus payment.

Expanded access to income support

For the six-month Coronavirus supplement period commencing on 27 April 2020, there will be expanded access to the income support payments listed above. This means:

Expanded access

Jobseeker Payment and Youth Allowance Jobseeker will be accessible to permanent employees stood down or lost employment as well as sole traders, the self-employed, casual workers, and contract workers who meet income tests as a result of the economic downturn due to Coronavirus.

This could also include a person required to care for someone who is affected by the Coronavirus.

Reduced means testing

Asset testing for Jobseeker Payment, Youth Allowance Jobseeker and Parenting Payment will be waived for the period of the Coronavirus supplement.

Income testing will still apply to the person’s other payments, consistent with current arrangements.

Reduced waiting times

– Ordinary waiting period waived

The one-week ordinary waiting period will be waived for people applying for Parenting Payment, Jobseeker Payment or Youth Allowance between 12 March 2020 and 11 June 2020.

The waiving of the one-week ordinary waiting period included in the Social Security (Ordinary Waiting Period Exemption) Instrument 2020, is relevant to people applying for Parenting Payment, Jobseeker Payment or Youth Allowance between 12 March 2020 and 11 June 2020.

It is not clear at this stage whether the waiving of the ordinary waiting period will be extended to six months.

– Liquid Asset test Waiting Period and Seasonal Work Preclusion Period waived

These waiting periods will be waived for recipients eligible for the Coronavirus supplement.

People currently serving a liquid asset waiting period will no longer need to serve that waiting period.

– Newly Arrived Residents Waiting Period (NARWP) waived

This waiting period will be temporarily waived for recipients eligible for Coronavirus supplement. When the Coronavirus supplement ceases, those people that were serving a NARWP will continue to serve the remainder of their waiting period, though the time the person was receiving the Coronavirus supplement will count towards their NARWP. Residency requirements still apply.

Note: Income Maintenance Periods and Compensation Preclusion Periods will continue to apply, as payments under these arrangements are treated as income.

People will not be permitted, and will need to declare that they are not, accessing employer entitlements (such as annual leave and/or sick leave) or Income Protection Insurance, at the same time as receiving Jobseeker Payment and Youth Allowance Jobseeker under these arrangements.

Faster claim process

- Accelerated claim process

To ensure timely access to payments, new applicants are encouraged to claim through on-line and mobile channels. If applicants do not have internet access, they can claim over the phone.

- Streamlined application process

A number of simplified arrangements will be put in place to make it easier to claim, including allowing new applicants to verify their identity over the phone. In addition, a number of verification requirements will be removed such as Employment Separation Certificates and proof of rental arrangements. In addition, the Job Seeker Classification Instrument assessment will not be required for people who have recently left jobs.

Flexible Jobseeking arrangements

Jobseekers who have caring responsibilities, or who need to self-isolate, will be able to seek an exemption from their mutual obligation requirements without the need for medical evidence.

Activities can be rescheduled if the job seeker is unable to attend as a result of the Coronavirus. Job Plans will be adjusted to a default requirement of four job searches a month (or one a week) to reflect softening labour market conditions.

Mutual obligations can be tailored for each individual to suit not only their needs but also the needs of the community.

Sole traders that become eligible for the Jobseeker Payment will automatically meet their mutual obligation requirements during this period by continuing to develop and sustain their business.

Job seekers are encouraged to stay job ready, connected to their employment services provider and up to date on potential job opportunities in their local area.

These changes ensure that job seekers can reliably access income support, safely look for work, fill critical vacancies as they emerge, develop their skills and job preparedness, contribute to their community and help the economy to bounce back stronger.

Support for business

Businesses should speak to their accountant regarding potential benefits. These include;

- Expanding instant asset write-off, Further information about the instant asset write-off can be found on the ATO website.

- Accelerated depreciation deductions for new assets

- Boosting cash flow for employers

The Government will provide an estimated 690,000 eligible small and medium business employers and an estimated 30,000 not-for-profit employers (including charities) with cash flow assistance of between $20,000 and $100,000.

For this purpose, a small or medium business or not-for-profit entity is one with less than $50 million in aggregated turnover in the previous income year. It appears that this proposal will apply to all types of business structures.

This cash flow assistance will be delivered as an initial series of payments of between $10,000 and $50,000, and a final series of payments equal to the total of the initial payments (ie, a further $10,000 to $50,000).

Initial series of payments

The initial series of payments will be made as a credit in the activity statement system starting from April 2020, with eligible entities that withhold tax from their employees’ salaries receiving a payment of 100% of the amount withheld, up to $50,000 in total.

Eligible entities that pay staff but are not required to withhold tax will still qualify for a minimum payment of $10,000.

Where an eligible entity lodges an activity statement and due to this payment is in a refund position, the ATO will deliver the refund within 14 days.

Where an eligible entity lodges its activity statements quarterly, it will be eligible for this payment in the March 2020 and June 2020 quarters.

Where an eligible entity lodges its activity statements monthly, it will be eligible for this payment for the monthly lodgements of March, April, May and June 2020. However, in this case the payment for March will be calculated at 300% (instead of 100%) to provide equity between quarterly and monthly lodgers.

Final series of payments

A final series of payments will be made that (combined) match the total of the initial series of payments. To be eligible for each of the final series of payments, the business or not-for-profit must continue to be active.

The final payments are again delivered as a credit in the activity statement system. Where an eligible entity lodges an activity statement and due to this payment is in a refund position, the ATO will deliver the refund within 14 days.

Supporting apprentices and trainees

Small businesses with less than 20 full time employees who retain an apprentice or trainee can apply for a wage subsidy of 50% of the wages paid to the apprentice / trainee during the 9 months from 1 January 2020 to 30 September 2020.

To qualify, the apprentice or trainee must have been in training with the eligible small business at 1 March 2020. A cap of $21,000 applies to the amount of subsidy that can be provided, per eligible apprentice / trainee ($7,000 per quarter).

In addition, employers of any size, and group training organisations, can apply for the subsidy where they re-engage an eligible out-of-trade apprentice or trainee.

Temporary relief for financially distressed businesses

Fact sheet for providing temporary relief for financially distressed businesses

Supporting credit flow to small and medium businesses

Fact sheet for Cash flow assistance for businesses