It is worthwhile revisiting the trade-off between paying off the mortgage quicker and investing more in super for retirement.

Background

While many people wait until their home loan is paid off before making additional voluntary super contributions, this may not always be the optimal approach.

Analysis reveals that, in many cases, people with the capacity to repay more than the minimum off their home loan, may be better off using their spare cashflow to make additional concessional super contributions (CCs) instead. This is because CCs can be a more tax-effective use of their surplus cashflow.

In some cases, some may be ahead despite a modest investment return in super. But many will need to be prepared to take a degree of investment risk to ensure the ‘make extra super contributions’ strategy is worthwhile.

Use cashflow more tax-effectively

While home loan repayments are usually made with after-tax money, super contributions can be:

- made with pre-tax dollars via a salary sacrifice agreement, or

- claimed as a tax deduction by making a personal contribution to super.

CCs can enable people to use their surplus cashflow more tax-effectively.

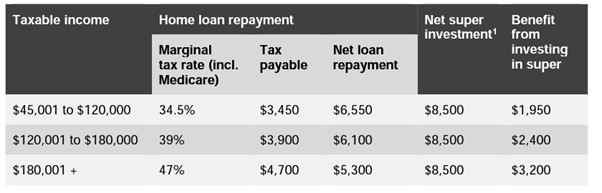

This is illustrated in the table below, where we compare the net amount that could be used for making CCs with repaying a mortgage, based on $10,000 in pre-tax cashflow and marginal tax rates (MTR) of 34.5%, 39% and 47% (including Medicare levy).

The outcome is determined by the difference in the tax rate inside and outside super.

For example, if taxable income is between $120,001 and $180,000, with $10,000 in surplus pre-tax income, a net loan repayment of $6,100 could be made or a net amount of $8,500 could be invested in super. That equates to a benefit of $2,400 by making extra super contributions.

Long term comparison

Modelling the potential benefit of investing $10,000 of pre-tax income into super with paying off the mortgage, over a 15-year period.

The ‘Value added after 15 years’ in the table below reflects the cumulative value of $10,000 pa invested in super, where an investment return is earned, and tax savings are derived (in the super column) and the cumulative interest savings from paying an additional $10,000 off the mortgage at different marginal tax rates (in the mortgage columns).

The ‘Added benefit in super’ reflects the difference between the results from investing more in super and paying off the mortgage, at different marginal tax rates.

| Results after 15 years of investing $10,000 or pre-tax income (5.5% interest) | |||||

| SUPER | MORTGAGE | ||||

| Tax Rates | 15% | 34.5% | 39% | 47% | |

| Rate Used | 7% | 5.5% | 5.5% | 5.5% | |

| Value added after 15 years | $213,597 | $146,777 | $136,693 | $118,766 | |

| Added Benefit in super | N/A | $66,820 | $76,904 | $94,831 | |

Case study assumptions

Home loan is linked with a 100% offset account. Amount is received in the bank account and super at the end of the year. Home loan interest rate is 5.5% pa in table above and 7% pa below. Net investment return for super is 7% pa. The investment return and interest rate assumptions are based on long-term expectations, are provided for illustrative purposes, and are not guaranteed. All marginal tax rates include 2% Medicare levy. Div 293 tax is not applicable, so tax on super contributions is 15%.

Other scenario results

While the above results favour making additional CCs, they are based on one set of interest rate and investment return assumptions, which we have held constant over the 15-year period.

If we assume home loan interest rates rise slightly, from 5.5% to 7%, the outcome for super still looks beneficial.

| Results after 15 years of investing $10,000 or pre-tax income (7% interest) | |||||

| SUPER | MORTGAGE | ||||

| Tax Rates | 15% | 34.5% | 39% | 47% | |

| Rate Used | 7% | 7% | 7% | 7% | |

| Value added after 15 years | $213,597 | $164.595 | $153,287 | $133,184 | |

| Added Benefit in super | N/A | $49,002 | $60,310 | $80,413 | |

While the above numbers compare investing in super and paying more off a mortgage, a thorough analysis of your circumstances must be done in order to determine the best use for surplus cashflow.

Other considerations

Liquidity needs

While making additional CCs could help some to retire with more super, it’s important to consider whether they may need to access the money before they meet a ‘condition of release’, such as retirement. A key benefit of making extra repayments into your home loan is that the money can usually be accessed at any time via a redraw facility.

Cashflow position

Not everyone will have sufficient surplus cashflow to make additional home loan repayments or super contributions. You will therefore need to consider how much you earn, the size of your mortgage and other financial commitments before considering this strategy.

Take greater advantage of CC cap

The 2023/24 CC cap is $27,500 for all individuals. Individuals with a total super balance below $500,000 at 30 June prior can utilise unused CCs that have accrued since 2018/19, enabling them to make CCs in excess of the annual cap from 2019/20 and subsequent financial years (up to 5 prior financial years). This is because their personal annual cap includes the unused CCs from prior years, as well as the annual cap for the current year. As a result, there are now opportunities to make large tax-effective super contributions.

To achieve the desired retirement lifestyle, you may need to make additional super contributions earlier than they had planned, rather than pay more off their mortgage. That way they can take greater advantage of the contribution cap over the remainder of your working life and potentially retire with more.

Div 293 tax

Although making CCs within the cap continues to be a tax-effective strategy, Div 293 imposes an extra 15% tax on CCs on high income earners. This is in addition to the 15% tax, payable by taxed funds, on CCs, making a total of 30%. Div 293 tax is payable when CC and income from certain sources exceeds $250,000 pa.

Age and work intentions

You should also consider your age and how long you plan to keep working and determine whether other strategies (or variations to this strategy) would be more suitable.

CGT implications when selling down assets

When making withdrawals from the super (accumulation) environment, it is important to take any capital gains implications into account. Capital gains tax (CGT) levied on realised capital gains within accumulation phase is also 15% (similar to earnings received from investments within the fund). However, a 1/3rd CGT reduction is applied to realised capital gains received from an investment that was owned for longer than 12 months, effectively reducing the tax on the gain to 10%. The amount of tax the fund pays may also be reduced by tax deductions or tax credits that apply to some types of investments.

Risk tolerance

Finally, you may need to be prepared to take on a moderate degree of investment risk to make it worthwhile increasing their CCs at the expense of paying off their mortgage earlier. Making additional mortgage repayments is considered a low-risk strategy and provides savings through lower interest costs. It may therefore be more appropriate for conservative investors to use surplus income to pay off their mortgage rather than contribute more to super.

Conclusion

While this strategy won’t suit everyone, it could help some to retire with more money in super. However, results will depend on their circumstances, including their age, risk profile and liquidity needs.