It’s a difficult time. Between see-sawing markets and a concerned community, it’s clear we’re dealing with a changed world and one in which financial advice has a new sense of urgency for many.

While there’s no way of knowing how long the uncertainty will last, we do know these dynamics will continue to test and challenge us all in ways we’ve likely never known before.

For now, navigating daily uncertainty is the new normal. Many industries have been hit hard by containment efforts related to COVID-19 and it’s hard not to be affected by what sometimes feels like wall-to-wall bad news.

Perhaps the toughest part is managing behaviour when the financial shocks keep coming and the “do-something” impulse kicks in. This is a time in which the value of advice is arguably more in focus – more valued – than ever.

The ‘value’ in advice

People are understandably hungry for answers and direction. Now is when advisors ‘lean in’ to this appetite for information and guidance and demonstrate practically to their clients how advice delivers value.

When it comes to advised clients, we know the question of ‘value for money’ generally boils down to three distinct parameters; portfolio value, or the ability to build a well-diversified portfolio matched to an investor’s risk tolerance, financial value –gauged by an investor’s ability to achieve a desired goal – and, lastly, emotional value.

It is in this third, more subjective dimension that advisers have so many opportunities to make a difference in the current climate.

The emotional value of advice is commonly felt by a client as a sense of financial wellbeing or peace-of-mind.

The question is how does ‘peace-of-mind’ look today in an environment when each way moves in the market are a daily occurrence, and volatility is a given.

Peace-of-mind is sticking to the ‘plan’

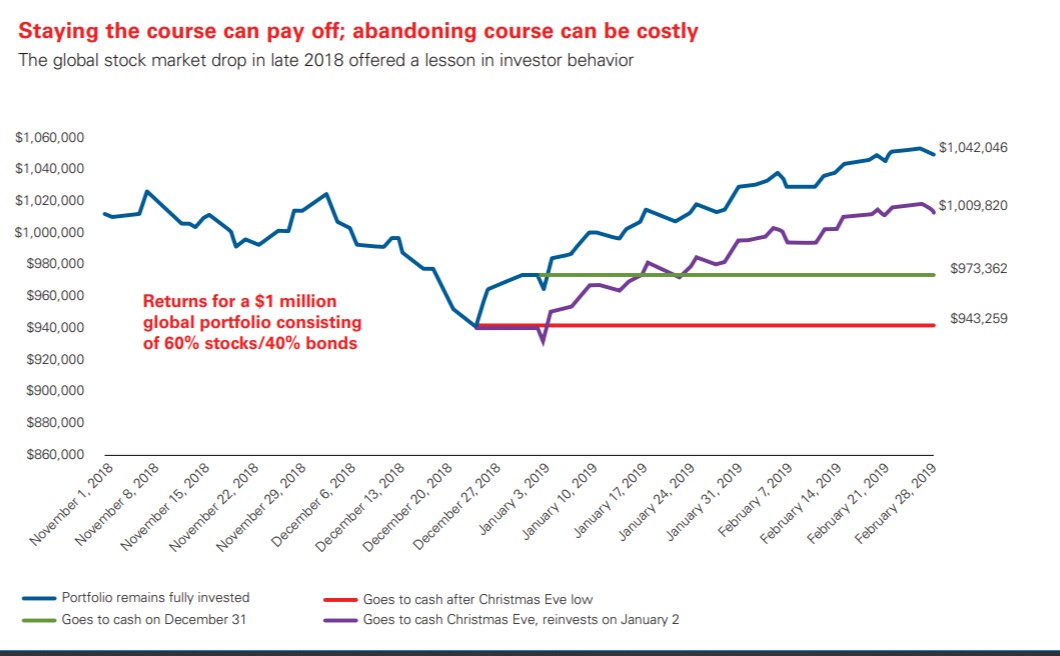

Key takeout: Abandoning the plan can be costly. An investment plan established during calmer times should not be ditched in periods of volatility.

Having a solid plan for how to tackle volatile markets is key. A plan is the most effective way to remind us to maintain perspective when all around are losing theirs.

The decision to “stay the course” is a simple but powerful investment plan for times such as these. It asks us to put our emotions to the side and use discipline and perspective instead.

Explaining the value of staying invested can be challenging but there are solid, evidence-based reasons why sticking to a plan is good advice for times like now. Here are three examples around the value of “staying the course” in turbulent times:

Abandoning the plan can be costly

Key takeout: During a downturn, some investors mistakenly believe that converting to cash will give a better long-term result. Evidence shows that such action potentially blocks you from enjoying the strong recoveries that have historically followed market downturns.

History has proven that in volatile markets often the best move for investors is often no move at all.

Downturns are a market occurrence that vary in length and severity, but history bears out that staying invested despite the short-term pain has served investors well in the past.

For instance, those that stayed invested through the global financial crisis and recession of 2008-09 and beyond were able to capture the upside from one of the longest stock market recoveries in US history.

Sources: Vanguard calculations, based on data from FactSet, as of February 28, 2019

Sources: Vanguard calculations, based on data from FactSet, as of February 28, 2019

Any changes should be made because of changes in your life, not changes in the markets.

Key takeout: Re-visit the rationale for the original asset allocation.

During a downturn it’s important to remind ourselves of the original plan and the rationale of decisions made as part of that long-term plan.

For many investors, being reminded that a specific asset allocation was the result of careful consideration and not arbitrarily assigned can provide an emotional anchor during panicked moments in the markets.

Asset allocation decisions reflect goals. If those goals are sound and matched to your risk tolerance, and – furthermore – are focussed on those things within your control (asset allocation and costs), there is every reason to stick with a plan and long-term goals.

It’s also sensible to rebalance into market volatility to ensure target asset allocation do not deviate from long-term goals.

Keep market swings in perspective. It is almost certain that there will be volatility ahead

Key takeout: Volatility is a given, but you can navigate uncertainty by focusing on those things within your control (asset allocation and costs.)

Global equity markets have experienced eight bear markets over the last 40 years, or one roughly every five years.

Although huge daily swings are enough to make anyone nervous it remains the case that investors will typically experience many market downturns over the course of their lifetime.

At times like these it’s more important than ever to help keep emotional reactions in check and be reminded of the value of those investment plans made in a calmer moment. By focusing on those factors within your control you can minimise the risk of making a knee-jerk decision that will cost you in the long run.

During moments of upheaval such as these, the value of solid financial advice is felt more keenly than ever.

As a financial coach, we aim to help client’s separate emotion from strategy, and find some peace-of-mind amidst all the daily uncertainty.

No one can predict just how disruptive the COVID-19 pandemic will ultimately be in coming months, but it is a good time to remember of the decision-making that went into investment plans and the power of sticking with those plans. This seemingly simple but important revisiting of investment plans is a concrete way for us to maintain direction in the coming months.