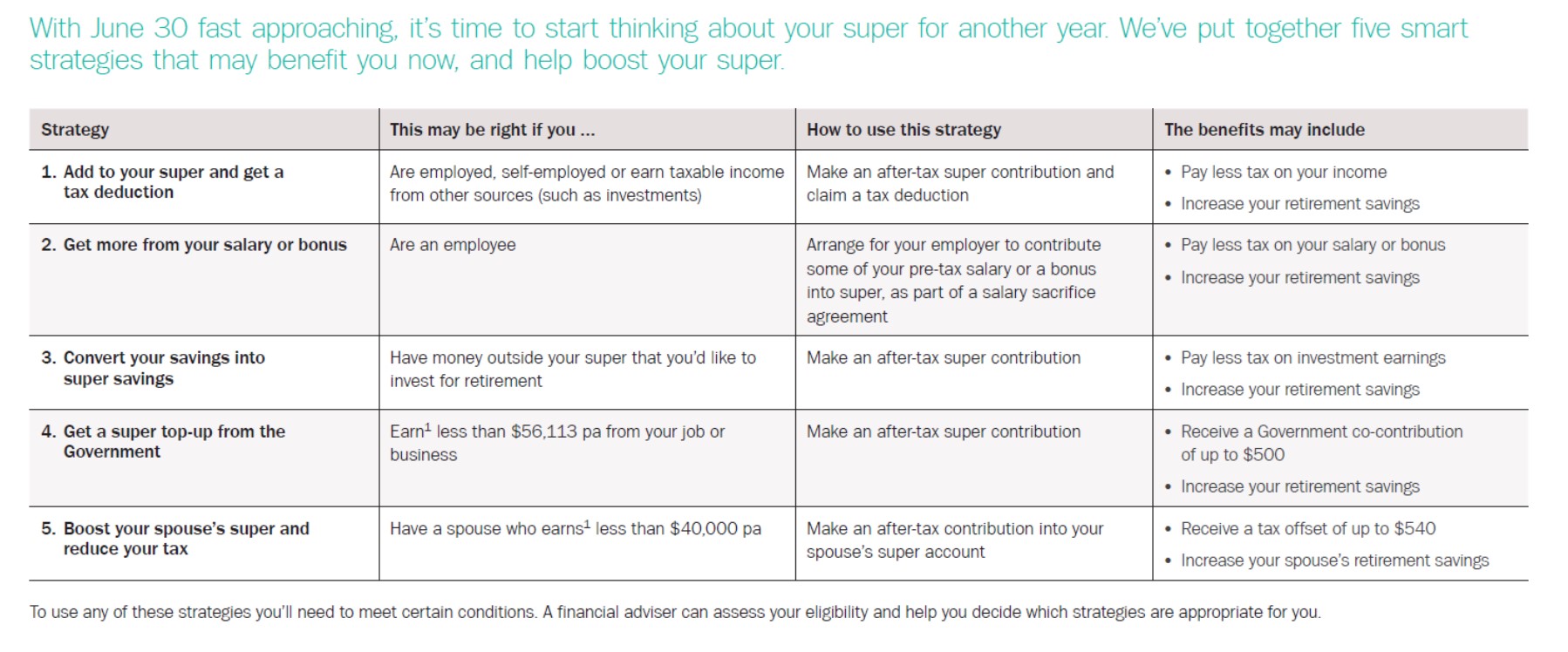

Smart super strategies for this EOFY

Want to help boost your retirement savings while potentially saving on tax?

Here are five smart super strategies to consider before the end of the financial year.

- Add to your super – and claim a tax deduction

If you contribute some of your after-tax income or savings into super, you may be eligible to claim a tax deduction. This means you’ll reduce your taxable income for this financial year – and potentially pay less tax. And at the same time, you’ll be boosting your super balance.

How it works

The contribution is generally taxed at up to 15% in the fund (or up to 30% if your income from certain sources is $250,000 or more). Depending on your circumstances, this is potentially a lower rate than your marginal tax rate, which could be up to 47% (including the Medicare Levy) – which could save you up to 32%.

Once you’ve made the contribution to your super, you need to send a valid ‘Notice of Intent’ to your super fund, and receive an acknowledgement from them, before you complete your tax return, start a pension, or withdraw or rollover the money.

Keep in mind that personal deductible contributions count towards your concessional contribution cap, which is $27,500 for the 2021/22 financial year. However, you may be able to contribute more than that without penalty if you didn’t use the your entire concessional cap in financial years since 1 July 2018 and are eligible to make ‘catch-up’ contributions.

Concessional contributions also include all employer contributions, including Superannuation Guarantee and salary sacrifice. Other eligibility rules may also apply so speak to your financial adviser for more information.

- Get more from your salary or a bonus

If you’re an employee, you may be able to arrange for your employer to direct some of your pre-tax salary or a bonus into your super as a ‘salary sacrifice’ contribution.

Again, you’ll potentially pay less tax on this money than if you received it as take-home pay – generally 15% for those earning under $250,000 pa, compared with up to 47% (including Medicare Levy).

How it works

Ask your employer if they offer salary sacrifice. If they do, it can be a great way to help grow your super tax-effectively because the contributions are made from your pre-tax pay – before you get a chance to spend it on other things.

You can only salary sacrifice amounts that you’re not yet entitled to receive. This includes both your regular salary, and any entitlement to a bonus. Remember salary sacrifice contributions count towards your concessional contribution cap, along with any superannuation guarantee contributions from your employer and personal deductible contributions. Also, you may be able to make catch up (extra) contributions if your concessional contributions were less than the annual concessional cap since 1 July 2018.

- Convert your savings into super savings

Another way to invest more in your super is with some of your after-tax income or savings, by making a personal non-concessional contribution.

Although these contributions don’t reduce your taxable income for the year, you can still benefit from the low tax rate of up to 15% that’s paid in super on investment earnings. This tax rate may be lower than what you’d pay if you held the money in other investments outside super.

How it works

Before you consider this strategy, make sure you’ll stay under your non-concessional contribution (NCC) cap, which in 2021/22 is $110,000 – or up to $330,000 if you meet certain conditions. That’s because after-tax contributions count as non-concessional contributions – and penalties apply if you exceed the cap.

Also, to use this strategy in 2021/22, your total super balance (TSB) must have been under $1.7 million on 30 June 2021.

If you’re 67–74, you’ll also need to meet the work test (or be eligible to apply the ‘work test exemption) to make NCCs this financial year. The work test will be removed for NCCs from 1 July.

Remember, once you’ve put any money into your super fund, you won’t be able to access it until you reach your preservation age or meet other ‘conditions of release’. For more information, visit the ATO website at ato.gov.au.

- Get a super top-up from the Government

If you earn less than $56,113 in the 2021/22 financial year, and at least 10% is from your job or a business, you may want to consider making an after-tax super contribution. If you do, the Government may make a ‘co-contribution’ of up to $500 into your super account.

How it works

The maximum co-contribution is available if you contribute $1,000 and earn $41,112 pa or less. You may receive a lower amount if you contribute less than $1,000 and/or earn between $41,113 and $56,112 pa.

Be aware that earnings include assessable income, reportable fringe benefits and reportable employer super contributions. Other conditions also apply – your financial adviser can run you through them.

- Boost your spouse’s super and reduce your tax

If your spouse is not working or earns a low income, you may want to consider making an after-tax contribution into their super account. This strategy could potentially benefit you both: your spouse’s super account gets a boost and you may qualify for a tax offset of up to $540.

How it works

You may be able to get the full offset if you contribute $3,000 and your spouse earns $37,000 or less pa (including their assessable income, reportable fringe benefits and reportable employer super contributions).

A lower tax offset may be available if you contribute less than $3,000, or your spouse earns between $37,000 and $40,000 pa.